Under the CreditPortfolio View model of credit risk, the conditional probability of default will be:

The unexpected loss for a credit portfolio at a given VaR estimate is definedas:

The sensitivity (delta) of a portfolio to a single point move in the value of the S&P500 is $100. If the current level of the S&P500 is 2000, and has a one day volatility of 1%, what is the value-at-risk for this portfolio at the 99% confidence and a horizon of 10 days? What is this method of calculating VaR called?

There are three bonds in a diversified bond portfolio, whose default probabilities are independent of each other and equal to 1%, 2% and 3% respectively over a 1 year time horizon. Calculate the probability that none of the three bonds will default.

Whichof the following statements are true in relation to Historical Simulation VaR?

I. Historical Simulation VaR assumes returns are normally distributed but have fat tails

II. It uses full revaluation, as opposed to delta or delta-gamma approximations

III. Acorrelation matrix is constructed using historical scenarios

IV. It particularly suits new products that may not have a long time series of historical data available

The cumulative probability of default for a security for 4 years is 11.47%. The marginal probability of default for the security for year 5 is 5% during year 5. What is the cumulative probability of default for the security for 5 years?

The sum of the stand alone economic capital of all the business units of a bank is:

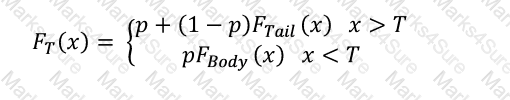

When fitting a distribution in excess of a threshold as part of the body-tail distribution method described by the equation below, how is the parameter 'p' calculated.

Here, F(x) is the severity distribution. F(Tail) and F(Body) are the parametric distributions selected for the tail and the body, and T is the threshold in excess of which the tail is considered to begin.

Which loss event type is the failure to timely deliver collateral classified as under the Basel II framework?

Which of the beloware a way to classify risk governance structures:

A Reactive, Preventative and Active

B. Committee based, regulation based and board mandated

C. Top-down and Bottom-up

D. Active and Passive

Which of the following cannot be used as an internal credit rating model to assess an individual borrower:

An operational loss severity distribution is estimated using 4 data points from a scenario. The management institutes additional controls to reduce the severity of the loss if the risk is realized, and as a result the estimated losses from a 1-in-10-year losses are halved. The 1-in-100 loss estimate however remains the same. What would be the impact on the 99.9th percentile capital required for this risk as a result of the improvement in controls?

Which of the following is not a risk faced by a bank from holding a portfolio of residential mortgages?

Which of the following are considered properties of a 'coherent' risk measure:

I. Monotonicity

II. Homogeneity

III. Translation Invariance

IV. Sub-additivity

For a hypotherical UoM, the number of losses in two non-overlapping datasets is 24 and 32 respectively. The Pareto tail parameters for the two datasets calculated using the maximum likelihood estimation method are 2 and 3. What is an estimate of the tail parameter of the combined dataset?

Which of the following credit risk models considers debt as including a put option on the firm's assets toassess credit risk?

According to the implied capital model, operational risk capital is estimated as:

If the annual default hazard rate for a borrower is 10%, what is the probability that there is no default at the end of 5 years?

Which of the following statements are true:

I. Pre-settlement risk is the risk that one of the parties to a contract might default prior to the maturity date or expiry of the contract.

II. Pre-settlement risk can be partly mitigated by providing for early settlement in the agreements between the counterparties.

III. The current exposure from an OTC derivatives contract is equivalent to its current replacement value.

IV. Loan equivalent exposures are calculated even for exposures that are not loans as a practical matter for calculating credit risk exposure.

Which of the following objectives are targeted by rating agencies when assigning ratings:

I. Ratings accuracy

II. Ratings stability

III. High accuracy ratio (AR)

IV. Ranked ratings

Which of the following statements is true

I. If no loss data is available, good quality scenarios can be used to model operational risk

II. Scenario data can be mixed with observed loss data for modeling severity and frequency estimates

III. Severity estimates should not be created by fitting models to scenario generated loss data points alone

IV. Scenario assessments should only be used as modifiers to ILD or ELD severity models.

Which of the following risks and reasons justify the use of scenario analysis in operational riskmodeling:

I. Risks for which no internal loss data is available

II. Risks that are foreseeable but have no precedent, internally or externally

III. Risks for which objective assessments can be made by experts

IV. Risks that are known to exist, but for which no reliable external or internal losses can be analyzed

V. Reducing the complexity of having to fit statistical models to internal and external loss data

VI. Managing the capital estimation process as to produce estimates in line with management's desired capital buffers.

The standalone economic capital estimates for the three business units of a bank are $100, $200 and $150 respectively. What is the combined economic capital for the bank, assuming the risks of the three business units are perfectly correlated?

Company A issues bonds with a face value of$100m, sold at $98. Bank B holds $10m in face of these bonds acquired at a price of $70. Company A then defaults, and the recovery rate is expected to be 30%. What is Bank B's loss?

If the loss given default is denoted by L, and the recovery rate by R, then which of the following represents the relationship between loss given default and the recovery rate?

Which of the following carry greater counterparty risk: a forward contract on a 10 year note, or a commercial paper carrying a AA credit rating with identicalmaturity and notional?

There are three bonds in a diversified bond portfolio, whose default probabilities are independent of each other and equal to 1%, 2% and 3% respectively over a 1 year time horizon. Calculate the probability that exactly 1 of the three bonds will default.

There are two bonds in a portfolio, each with a market value of $50m. The probability of default of the two bonds are 0.03 and 0.08 respectively, over a one year horizon. If the probability of the two bonds defaulting simultaneously is 1.4%, what is the default correlation between the two?

The definition of operational risk per Basel II includes which of the following:

I. Riskof loss resulting from inadequate or failed internal processes, people and systems or from external events

II. Legal risk

III. Strategic risk

IV. Reputational risk