Cash collections and payments for purchases would be included in which of the following budgets as part of the overall master budget?

Managers have several different methods from which to choose when evaluating long-term investments. Which method disregards the time value of money as a factor?

Ladron Candies is analyzing sales and production data for the holiday boxes they produced last year. The company expected to use 0.10 direct labor hours to produce one box of specialty candy, and the variable overhead rate was $2.00 per hour. According to payroll records, the company paid for a total of 104,000 hours of direct labor wages. The actual variable overhead costs totaled $200,000. They sold 800,000 boxes of candy to retailers. What is the variable overhead efficiency variance?

Wycliff Corporation practices activity-based management at their manufacturing facility. Which of the following events would most likely be the result of a decision made using activity-based management theory?

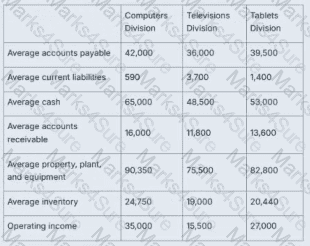

This is select financial statement data for the three divisions of Technology Goods, Inc. Assuming all assets are operating assets, what is the return on investment for each division?

Given Data from Image (relevant for ROI):

Let’s calculate ROI for each division using:

ROI = Operating Income / (Average Cash + Accounts Receivable + Property, Plant, Equipment + Inventory)

Step 1: Compute average operating assets for each division:

Computers Division:

= 65,000 (Cash) + 16,000 (AR) + 90,350 (PP&E) + 24,750 (Inventory)

= 196,100

ROI = 35,000 / 196,100 ≈ 17.85%

Televisions Division:

= 48,500 + 11,800 + 75,500 + 19,000 = 154,800

ROI = 15,500 / 154,800 ≈ 10.01%

Tablets Division:

= 53,000 + 13,600 + 82,800 + 20,440 = 169,840

ROI = 27,000 / 169,840 ≈ 15.89%

Wycliff Corporation manufactures several different styles of bicycles. Managers appropriately record direct materials and direct labor into work-in-process accounts during production. To apply manufacturing overhead, managers consider cost pools for assembly and shipping to calculate a predetermined overhead rate for each department. Which of the following best describes the method used by Wycliff Corporation for allocating manufacturing overhead costs?

Valley Manufacturing uses a process costing system. Which of the following journal entries would correctly record $3,180 of manufacturing overhead to the assembly department?

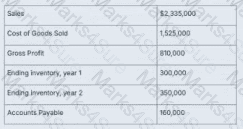

This is select financial statement data for Binks Corporation. What is the inventory turnover ratio for year 2?

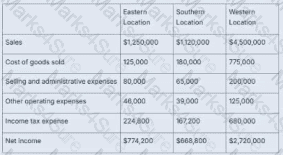

Waffles, Inc. is evaluating their annual bonus allocations for restaurant division managers. This is the segmented income statement data for the three individual restaurant locations of Waffles, Inc. What does this information tell us about the performance of each division manager?