[Insurance as a Contract – Subject of Insurance]

What does the term "subject of insurance" refer to?

[Insurance Companies / Reinsurance]

In a non-proportional (excess of loss) reinsurance contract, the reinsurer agrees to pay the portion of any loss thatexceeds $80,000, up to an additional$100,000.

How much would the primary insurer pay for an insured loss of$60,000?

[Insurance as a Contract – Indemnity]

Kamal’s home has an actual cash value (ACV) of $380,000 and is insured for $400,000. The house suffers $180,000 damage. Which amount indemnifies Kamal?

[Claims]

Ivana is in an auto accident. The agreed market value of her vehicle is$17,000.

Her policy deductible is$1,500.

A wrecking company offers$3,000for the salvage.

Ivana chooses tokeep the salvage.

What amount will Ivana receive?

[Insurance as a Contract: The Insurance Policy]

What is stated in the insuring agreements of a policy?

Jack owns a convenience store. During a severe hurricane, he places sandbags in front of his store and boards up the windows. Which technique of loss control is Jack utilizing?

[Underwriting and Rating: Setting Insurance Rates]

What is the annual premium for a building insured for$500,000at a rate of$0.80 per $100?

[Insurance Companies]

Which type of insurance company has the same capital structure as any other capital enterprise?

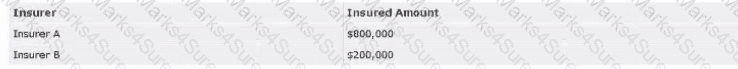

Insurer A and Insurer B cover the same building and the policies are NOT subject to contribution. The building sustains a loss of $450,000. How can the insured claim for their loss?

[Insurance as a Contract: The Insurance Policy]

George emails his cousin offering to buy her textbooks for $500. He states that unless she replies “no,” they have a deal. Which essential element of a binding contract is missing?

[Sales and Distribution of Insurance]

Orianna is an insurance professional who acts on behalf of the insurerandthe insured. She owns her client list and is paid commission once policies are arranged. What is her profession?

[Claims]

Antonio lights a firecracker and throws it to Brett. Brett tosses it to Sandra. Sandra catches it and throws it to Celina. It explodes in Celina’s hands, injuring her. Who is the immediate cause of the loss?

[Insurance as a Contract: The Insurance Policy]

Karl recently purchased a house in Winnipeg. Prior to the purchase he asked if the house had termites. The house was infested, but the seller falsely stated there were none. After signing the contract, Karl discovered the infestation. Which element makes the purchase contract voidable?

A company suffers a $100,000 property loss at its commercial location. If Insurer X and Insurer Y have policies subject to the same terms and conditions, and there is no deductible, what will each insurer pay based on the information below?

Insurer X insured amount: $400,000

Insurer Y insured amount: $100,000

[Introduction to Risk and Insurance]

Why does the need for liability insurance arise?

[Introduction to Risk and Insurance – Risk Management Techniques]

The risk manager of an oil refinery is seeking ways to transfer the pollution risk of a new drilling method. What is the best option?

[Insurance Categories and Functions]

MacMan Inc. employs several salespersons who travel throughout Canada with samples of its products. Which type of coverage does MacMan Inc. require to protect its samples while in the salespersons' possession?

[Insurance as a Contract: The Insurance Policy]

If a dispute arises between the insurer and insured over a claim, which party is responsible for satisfying the courts that a concealment of material facts has occurred?

[Regulatory Framework]

Maritime Insurance has met all requirements to be incorporated as an insurance company in Canada. Why would it prefer to incorporate under the Nova Scotia provincial statute rather than the federal statute?

[Introduction to Risk and Insurance]

What is a disadvantage of loss retention through borrowing?

[Insurance Companies]

What type of company has the authority to bind coverage for a specific line of business as outlined by an insurer?

[Risk Management – Post-Loss Objectives]

What is a post-loss objective of risk management for an organization?

[Insurance Documents and Processes]

Which problem could arise with an oral binder?

[Regulatory Framework – Statutory Conditions]

What is the correct placement of statutory conditions to their respective insurance policy?

[Introduction to Risk and Insurance – Benefits of Insurance]

How would a moving and storage company benefit from purchasing insurance to cover customers’ goods while in transit?