Succeed Insurance has a strategic initiative to offer pay-as-you-drive personal auto insurance to compete with other large carriers. Customers who choose these policies

must either own a vehicle that is equipped with a monitoring device or agree to install a device provided by Succeed. The monitoring device collects information about how

the drivers of a covered vehicle drive, including how fast they drive, how hard they brake, and how many miles/kilometers the vehicle travels within a policy period.

This information is logged, and premiums are based on how the insured's driving behavior is categorized. When a claim is reported, the log files must be obtained in order to

analyze the information captured by the monitoring device at the time of the incident.

Succeed plans to collect and evaluate the Vehicle Monitoring Log files in the first implementation phase, which is scheduled for release in 60 days. The project sponsors

have instructed the implementation team to use base product functionality over customization. Integration should be leveraged where possible to avoid manual data entry.

The New Claim Wizard must capture whether or not the vehicle has a monitoring device installed when a personal auto claim is created against a pay-as-you-drive policy.

Which feature of the base product enforces this claim creation requirement?

What two pieces of information enable the Business Analyst (BA) to trace back to the root cause of an issue? (Choose two.)

Succeed Insurance handles a small volume of asbestos claims in their legacy system. These claims can remain open for many years to cover medical costs to claimants due to illnesses caused by exposure to asbestos in the workplace.

Succeed has the following requirements for paying these claims with the New Check Wizard:

. No indemnity (claim cost) payments can be made until a medical assessment of the claimant is completed.

. Expense payments can be made to cover Succeed's costs to process the claim.

Which feature in the base product can be extended to support both of these requirements?

A sales executive and business traveler has a full coverage auto policy through his insurance company. The executive lives in Detroit, Michigan and often drives across the border to visit client offices in Canada.

While driving in downtown Toronto, the executive's car was hit by a truck coming the wrong way. He called his insurance company to report a claim for this accident. However, the Customer Service Representative (CSR) cannot confirm there is an active policy on file.

How should this claim be handled?

Losses incurred because of an accident with other vehicles can be very large. Because of the risk of large losses, all claims must include both a police report and the details of any passengers in the vehicle, whether they sustained injuries or not. The claim must show whether there were passengers in the vehicle at the time of the accident. Succeed wants the ability to include a very detailed description of the loss event information on intake of the claim.

When the claim is created, Succeed wants to flag the claim with a reminder for the Adjuster to contact the insured.

There should be reminders for the Adjuster to complete the following items for every new claim created:

. Review any photographs of the accident

. Contact and Interview each passenger

. Collect statements from each witness

. Record the vehicle's mileage

Which business requirement is based on assumptions?

Satisfied with the outcome of a Requirements Workshop, a Business Analyst (BA) attributed the success to preparation. The assigned task had been to document the requirements for capturing details on vehicle incidents for Personal Auto.

Before the session, the BA reviewed ClaimCenter functionality by creating a new Personal Auto Claim involving physical damage to a vehicle.

During review, the BA saw that ClaimCenter did not have a graphical representation of a vehicle with clickable hot spots to identify the damage areas like they have in their current application.

Upon further research, the BA found that Guidewire does offer this functionality and even provides a Graphical Incident Capture Accelerator to ease implementation.

During the workshop, the BA was able to clearly present all options for capturing vehicle incident details. Instead of having to develop the Vehicle Incident Capture functionality from scratch, the team was able to make a quick decision to add this functionality and end the meeting 30 minutes early.

Which two outcomes demonstrate the importance of preparing for a Requirements Workshop by becoming familiar with the features and functionality of ClaimCenter? (Choose two.)

An Adjuster at Succeed Insurance creates a check with a partial payment of $1,200 for medical expenses payable to a claimant who was injured in a collision. The check has completed the following processing steps:

. The payment exceeded the Adjuster's authority limits, changing the status to Pending Approval.

. The Adjuster's supervisor reviewed and approved the payment, changing the status to Awaiting Submission.

. A batch process sent the check to the external check processing system, changing the status to Requested when ClaimCenter received an update from the external system.

The Adjuster received new information indicating that the check amount should be reduced to $950.

Which action should the Adjuster take?

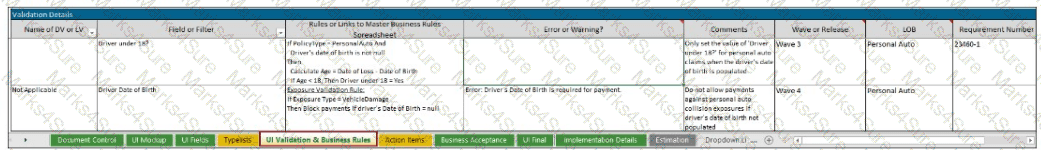

Succeed Insurance requires that a new 'Driver under 18?' field be added to the vehicle incident screen for personal auto claims to indicate whether or not the driver of the vehicle was a minor when the loss occurred. The field will be set by calculating the driver's age using the date of loss and the driver's date of birth.

There are two validation requirements:

The field must be set if the 'Date of Birth' field for the driver is not null.

No payments can be made for collision exposures if the 'Date of Birth' field for the driver of the vehicle is null.

A Business Analyst (BA) documents the validation requirements in the validation tab of the User Story Card 'Adjudicate - Update Maintain Vehicle Incident for Personal Auto Claims' as shown in the exhibit.

What information in the two validation examples is either missing or incorrectly documented? (Choose two.)

Succeed Insurance allows field Adjusters to write checks directly to the insured to cover damage costs for minor claims such as:

Personal auto claims involving cracked windshields

Homeowners claims involving minor glass breakage

The Adjuster uses the Manual Check Wizard to record the check number and amount against a reserve line. Succeed requires Supervisor approval for all manual checks to ensure that the paper checks are verified against the payment information in ClaimCenter.

Which two limits or rules must be configured in ClaimCenter to ensure that these manual payments are sent to the correct person for approval? (Choose two.)

Which scenario shows a Business Analyst (BA) demonstrating an important way to use Guidewire's Business Process Flows during a product implementation?

Succeed Insurance has plans to expand operations in Greeley, Colorado. Due to a history of hailstorm related damage in the area, the company plans to offer reimbursement for hail damage as an option.

Which two actions should the Business Analyst (BA) take to determine the requirements for the project? (Choose two.)

Succeed Insurance had an embarrassing event last month that had potential legal ramifications. One of their Customer Service Representatives (CSR) shared details of a celebrity's personal auto claim on social media. Fortunately for Succeed, the celebrity decided not to pursue legal actions as long as Succeed agreed to resolve the potential for future occurrences within the next 30 days.

Succeed executives immediately reacted to the situation by establishing new guidelines regarding claim security. The Business Analyst (BA) assigned to the project researched ClaimCenter base product capabilities and held several requirements gathering sessions designed to document their strategy. The new requirements indicate that only authorized users should be looking at celebrity claims.

Which two features should be used to meet the new requirements? (Choose two.)