Section A (1 Mark)

Division of the market into groups based on variables such as age, gender, size, income, occupation, education, religion, race and nationality comes under which of the following market segmentation?

Section A (1 Mark)

A(n)______________________ loan is a short- or medium-term loan repayable in two or more consecutive payments, usually monthly or quarterly.

Section A (1 Mark)

Mr. Raghav is now 40 years old. He has invested some amount in an annuity which will pay him after 10 years Rs. 30,000/- p.a. at the end of every year for 10 years. Rate of interest is 6% p.a. Calculate how much he has invested today?

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the Finance Act passed by the Parliament for various years. The current rates for Royalities are:

Section C (4 Mark)

Read the senario and answer to the question.

Sajan wants to cover for the expenses of his family without compromising their present lifestyle till the expected life time of Jennifer in case of his untimely death. He consumes 8% of monthly expenses exclusively on self. You advise him that the child plan covers a different goal. Assuming the cover proceeds are invested in a Balanced MF scheme, he should supplement his cover by taking a term insurance for _________ immediately to cover such future expenses. (Please ignore taxes and charges, if applicable, in regular withdrawals from Balanced MF scheme to meet proposed monthly expenses).

Section B (2 Mark)

An employee benefit plan can generally help in accomplishing all of the following items except:

Section C (4 Mark)

As a CWM® you recommended Mr. Raj Malhotra to put his money in Asset A offering 15% annual return with a standard deviation of 10%, and balance funds in asset B offering a 9% annual return with a standard deviation of 8%. Assume the coefficient of correlation between the returns on assets A and B is 0.50. Calculate the expected return after 1 year and standard deviation of Mr. Raj Malhotra’s portfolio.

Section C (4 Mark)

Read the senario and answer to the question.

By calculating HLV of Mahesh indicate the shortfall in his life insurance coverage using the given data:

Mr. Mahesh age 52, retirement age 60, paying professional tax of Rs. 5800 and income tax subject to allowable deductions as Rs. 230000, reasonable self maintenance expenditure estimated Rs. 140000 p.a., life insurance premium for self Rs. 25000 with total sum assured Rs. 1200000. He also pays insurance premium of Rs. 15500 and Rs. 7000 for life insurance policy of his wife and son respectively. Rate of interest assured for capitalization of future income is at 7%

Section C (4 Mark)

Mr. Dinesh constructs a BULL Call Spread Strategy with one Nifty Call Option having a Strike price of Rs. 4100 available at a premium of Rs. 170.45 and another Nifty Call option with a strike price Rs. 4400 at a premium of Rs. 35.40.

The Net Payoff of BULL Call Spread Strategy

• If Nifty closes at 4300

• If Nifty closes at 3700

Section A (1 Mark)

In US Over one-half the money spent by state and local governments goes to just three services. Which of the following is not one of these services?

Section B (2 Mark)

Mr. Murti is working in a reputed company and earning Rs. 4,00,000/- p.a. and is now 50 years old. He has invested Rs. 1,50,000/- in an annuity which will pay him after 5 years a certain amount p.m. at the beginning of every month for 10 years. Rate of interest is 8% p.a. Calculate how much he will receive at the beginning of every month after 5 years?

Section A (1 Mark)

____________refers to the tendency of people to think of currency in nominal, rather than real terms

Section B (2 Mark)

An assessee was allowed deduction of unrealized rent to the extent of Rs. 40,000 in the past although the total unrealized rent was Rs. 60,000. He is able to recover from the tenant Rs.45,000 during the previous year on account of such unrealized rent. He shall be liable to tax to the extent of:

Section B (2 Mark)

A typical personal accident policy would normally have provisions to pay

Section C (4 Mark)

Suppose Nifty is at 4500 in May. An investor, Mr. A, executes a Short Strangle by selling a Rs. 4300 Nifty Put for a premium of Rs. 23 and a Rs. 4700 Nifty Call for Rs 43.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3735

• If Nifty closes at 5265

Section B (2 Mark)

How much should you pay for a share of stock that offers a constant growth rate of 10%, requires a 16% rate of return, and is expected to sell for Rs50 one year from now?

Section B (2 Mark)

Reliance Ltd. has issued a preferred stock that pays Rs.10 per share. The dividend is fixed and the stock has no expiration date. What is the intrinsic value of Reliance Ltd. stock, assuming a discount rate of 14%?

Section C (4 Mark)

Zenith Finance is a big financial firm which owns several mutual funds. The funds are managed individually by portfolio managers but it has an investment committee that oversees all of the funds. This committee is responsible for evaluating the performance of the funds relative to the appropriate benchmark and relative to stated investment objectives of each individual fund. During a recent investment committee meeting, the poor performance of its Equity Funds were discussed. In particular, the inability of the portfolio managers to outperform their benchmarks was highlighted. The net conclusion of the committee was to review the performance of the manager responsible for each fund and dismiss those managers whose performance had lagged substantially behind the appropriate benchmark.

The fund with the worst relative performance is the Zenith Large Cap Fund which invests in large cap stocks. A review of the operations of the fund found the following:

• The turnover of the fund was almost double that of other similar style mutual funds

• The fund’s portfolio manager solicited input from her entire staff prior to making any decision to sell an existing holding

• The beta of the Zenith Large Cap Fund’s portfolio was 65% higher than the beta of other similar style mutual funds

• The portfolio manager refuses to increase the Capital Goods sector weighting because of past losses the fund incurred in the sector

• The portfolio manager sold all the fund’s Oil Marketing Companies stocks as the price per barrel of oil rose above $105. He expects oil prices to fall back to the $80 to $85 per barrel

• No stock is considered for purchase in the Large Cap Fund unless the portfolio manager has 10 years of financial information on that company.

A committee member made the following 2 comments:

Comment 1: “One reason for the poor performance of Large Cap Mutual Fund is that the portfolio lacks recognizable companies. I believe that good companies make good investments

Comment 2: “The portfolio manager of the Large Cap Fund refuses to acknowledge his mistakes. He seems to sell stocks that appreciate, but she holds stocks that have declined in value

The two behavioral biases exhibited respectively in the above 2 comments from the committee are:

Section A (1 Mark)

Which of the following statements about Real Estate Investment Trusts is/are true?

Section A (1 Mark)

A “Family Office” segment client has investible assets worth of

Section C (4 Mark)

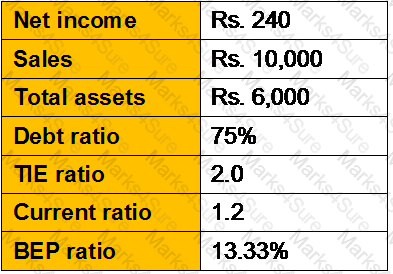

Tapley Dental Supply Company has the following data:

If Tapley could streamline operations, cut operating costs, and raise net income to Rs300, without affecting sales or the balance sheet (the additional profits will be paid out as dividends), by how much would its ROE increase?

Section B (2 Mark)

Dharampal has let out his house property at monthly rate of Rs. 12000. He has paid Rs.3500 as annual municipal tax. He wants to know the Net Annual value of his house at Bhuj for AY 2011-12. The Municipal value of the house is Rs. 90,000, Fair rent Rs. 1,40,000, Standard rent Rs. 1,20,000. The house was vacant for one month during the previous year 2010-11 and the rent has not changed since then.

Section A (1 Mark)

The cost which the Wealth management firms would generally not be able to fully absorb the revenue shock in the near future is known as Sticky Cost.

Section B (2 Mark)

It was unconstitutional for the U.S. government to levy an income tax before the passage of which amendment?

Section B (2 Mark)

Akash has only compulsory third party policy for his car. He jumped a red light and collided with another car and then with the boundary wall of a nearby house. Damage to his car was of Rs. 17,000/-, damage to other car was of Rs. 15,000/- and damage to the boundary wall of house was of Rs. 15,000. The insurance policy of Akash will pay:

Section C (4 Mark)

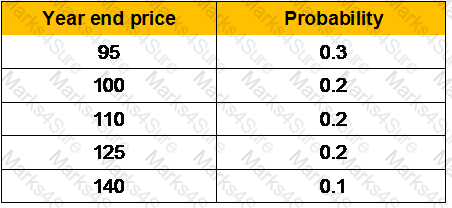

A share pays nil dividend and its current market price is Rs.100. The possible selling prices at the end of a year and the probabilities are:

What is the expected rate of return at the end of the year?

Section A (1 Mark)

The assessed is charged to income-tax in the assessment year following the previous year:

Section B (2 Mark)

In case of a defined benefit plan where the benefit payable is based on the terminal salary, an increase in of 10% of the wages of the employees would increase the contribution to be made by the employer for the benefit by

Section C (4 Mark)

Read the senario and answer to the question.

What would be the taxable amount on gratuity received by Jogen, if he would retired from an organization where employees are not covered under Gratuity Act?

Section A (1 Mark)

Amit has monthly net income of Rs10500. He has a house payment of Rs 4500 per month, a car loan with payments of Rs 2500 per month, a Visa card with payments of Rs 500 per month, and a credit card with a local department store with payments of Rs 1000 per month.

What is Amit's debt payments-to-income ratio?

Section A (1 Mark)

Which of the following statements regarding debit and credit card liability is correct?

Section C (4 Mark)

Read the senario and answer to the question.

Approximately how much amount she must sacrifice to provide the income stream for her mother?

Section C (4 Mark)

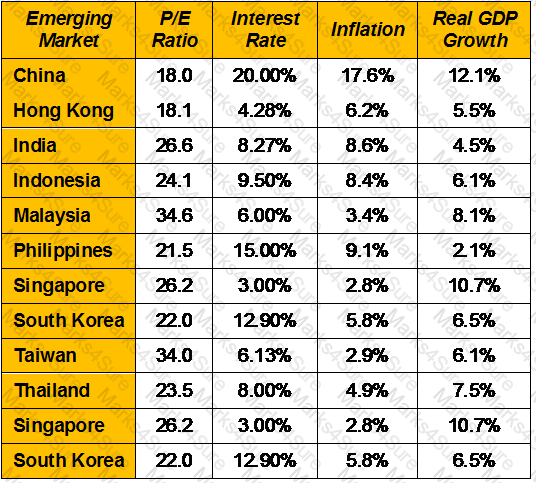

The following were P/E ratios for some Asian markets in February 1994, with relevant information on interest rates and economic growth:

Assuming the dividend payout ratio in each of these countries is 60%, estimate the P/E ratio in South Korea and Thailand, based upon stable growth. (Use a risk premium of 7.5% over the risk-free rate in each country.)

Section B (2 Mark)

Mr. X gives Rs. 200000 to Mrs. X as gift. She invests in a proprietary concern and incurs a loss of Rs. 40000

Section A (1 Mark)

As per Hindu succession Act 1956 following person is not considered as a class I heir of the person who dies intestate

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the Net Worth of Mr. Adhikari as on 31/03/2009.

Section B (2 Mark)

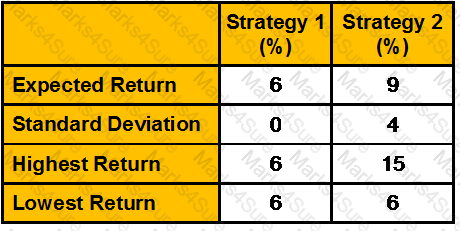

Consider these two investment strategies:

Strategy ___ is the dominant strategy because __________.

Section A (1 Mark)

investment plan pays Rs. 1 lac at the beginning of 10th year for 5 years and Rs. 2 lacs for next 5 years. If the rate of interest is 10% per annum. What will be the present value of this investment?

Section A (1 Mark)

A rapidly growing GDP indicates a(n) ______ economy with ______ opportunity for a firm to increase sales.

Section B (2 Mark)

Reproduction cost has been estimated as Rs 350,000 for a property with a 70-year economic life. The current effective age of the property is 15 years. The value of the land is estimated to be Rs 55,000. What is the estimated market value of the property using the cost approach, assuming no external or functional obsolescence?

Section B (2 Mark)

You buy a share of ABC Ltd for Rs. 20. You expect it to pay dividends of Re.1, Rs.1.10 and Rs.1.21 in coming three years. Calculate the growth rate in dividend:

Section A (1 Mark)

Garima deposits Rs. 2,000/- every month in an account and is getting interest @ 12 % per annum compounded monthly. How much will be her nest egg after 10 years ?

Section A (1 Mark)

Ratio of loading charge over the gross rate is called _________

Section A (1 Mark)

Which of the following statements about the difference between the SML and the CML is/are TRUE?

Section B (2 Mark)

Calculate the expected rate of return for M/S X Ltd. from the following information:

Section B (2 Mark)

Mr. X gives Rs. 200000 to Mrs. X as gift. She invests in a proprietary concern and incurs a loss of Rs. 40000.

Section C (4 Mark)

Pizer Drugs, a large drugstore chain, had sales per share of Rs122 in 1993, on which it reported earnings per share of Rs2.45 and paid a dividend per share of Rs1.12. The company is expected to grow 6% in the long term, and has a beta of 0.90. The current Risk Free Rate is 7%.

Estimate the appropriate Price for Pizer Drug and what would the profit margin need to be to justify the price per share if the stock is currently trading for Rs34 per share, assuming the growth rate is estimated correctly,

Section A (1 Mark)

An investor will take as large a position as possible when an equilibrium price relationship is violated. This is an example of _________.

Section A (1 Mark)

Which of the following is not a Key Benefit of the In-kind process used by the ETFs?

Section A (1 Mark)

The eligibility Criteria for Self Employed Professionals & Businessman for minimum age of the applicant in case of personal loan is:

Section A (1 Mark)

The Net Operating Income (NOI) for a real estate investment is calculated as:

Section B (2 Mark)

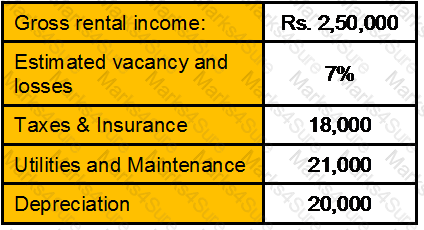

Mahesh wants to sell a property for Rs. 30 lakhs. He is earning rent from tenant Rs. 3,60,000. He is spending following amounts annually on that property

Based on the above information what should be the value of the property would be:

Section B (2 Mark)

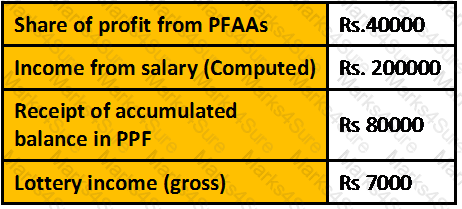

Choose the amount of final tax liability of R for the assessment year 2007-08:

Section B (2 Mark)

Which of the following is a reasonable assumption to make about the understanding of a client on the Wealth planning Process?

Section B (2 Mark)

Calculate the NOI for an office building with the following information:

Section B (2 Mark)

A constant proportion portfolio insurance (CPPI) policy calls for:

Section A (1 Mark)

Which of the following factors have proven most important in credit scoring models?

Section B (2 Mark)

Mr. Kishan owns a factory producing some small spare parts.Under which policy he can get cover against the claim for paying damages and legal costs arising from any bodily injury or damage in the premises of his property ?

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Royalties in Mauritius is charged at:

Section B (2 Mark)

The estimated Net Operating Income of an office building is Rs. 12000 per year. An appraiser decide the appropriate capitalization rate is 12% comprised of 10% return on investment and 2% for depreciation, what is the estimated value of the building?

Section A (1 Mark)

H Ltd, a UK resident company, owns 100% of the share capital of two other UK companies and 80% of the share capital of T SA, a company resident in Italy.H Ltd has three associated companies.

Section A (1 Mark)

______________are bonds issued by governments that pledge their "full faith and credit," including tax revenues, to repayment in US.

Section B (2 Mark)

Which of the following two outcomes is an example of Loss Aversion Bias:

Section A (1 Mark)

A cognitive heuristic in which decisions are made based on how representative a given individual case appears to be independent of other information about its actual likelihood. We tend to think that trends we observe are likely to continue. Which of the following is most likely consistent with this bias?

Section B (2 Mark)

Mr. Rai has received a house under a will on death of his uncle in the financial year 1985-86. His uncle purchased the house on 1-4-1968 for Rs.7 lakh. Mr. Rai has sold this during the financial year 2011-12 for Rs.62 lakh. Calculate the taxable amount of capital gain if the fair market value of house as on 1-4-1981 is Rs.20,00,000/- CII-12-13: 852,11-12: 785,10-11:711]

Section B (2 Mark)

The breakdown of commodity future returns over the past 30 days for 2 upcoming oil future contracts is given below:

What is the roll return for the period 15th September to 15th October for the contracts maturing in November and February?

Section B (2 Mark)

If after the partition of an HUF 2 members became partners in 3 firms on behalf of their respective HUFs and they also become partners in a fourth firm. The funds were obtained by means of loans from the other 3 firms. The share incomes of the members from the fourth firm were assessable as their individual income only.

Section A (1 Mark)

The CDO structures which are used by asset management companies, insurance companies and other investment shops with the intent of exploiting a mismatch between the yield of underlying securities and lower cost of servicing the CDO structures are called___________.

Section B (2 Mark)

A bond has a market value of Rs100,000 and a duration of 9.42. What is the price value of a basis point?

Section C (4 Mark)

Read the senario and answer to the question.

You have reviewed the investments of Nimita for the purview of retirement. You advise that a balance be restored from risk perspective and accordingly Rs. 15 lakh be shifted to a Debt MF scheme. You advise to further start SIPs immediately in the ratio of 60:40 in the newly started debt MF scheme and the existing Equity MF scheme for the next 21 years to accumulate a corpus so that the same sustains for the next 25 years if invested in an investment instrument yielding 7.50%. What approximate amount of SIPs should be made in Debt and Equity MF schemes?

Section C (4 Mark)

Suppose you have decided to sell your house and downsize by acquiring a townhouse that you have been eyeing for several years. You do not feel extreme urgency in selling your house; but the associated taxes are eating into your monthly cash flow, and you want to unload the property as soon as possible. Your real estate agent, whom you have known for many years, prices your home at Rs 90,00,000—you are shocked.

You paid Rs 250,000 for the home only 15 years ago, and the Rs 900,000 figure is almost too thrilling to believe. You place the house on the market and wait a few months, but you don’t receive any nibbles. One day, your real estate agent calls, suggesting that the two of you meet right away. When he arrives, he tells you that Pharma Growth, a company that moved into town eight years ago in conjunction with its much-publicized initial public offering (IPO), has just declared bankruptcy.

Now, 7,500 people are out of work. Your agent has been in meetings all week with his colleagues, and together they estimate that local real estate prices have taken a hit of about 10 percent across the board. Your agent tells you that you must decide the price at which you want to list your home, based on this new information. You tell him that you will think it over and get back to him shortly.

Assume your house is at the mean in terms of quality and salability.

What is your likeliest course of action if you exhibit Anchoring and Adjustment bias?

Section C (4 Mark)

National City Corporation, a bank holding company, reported earnings per share of Rs2.40 in 1993, and paid dividends per share of Rs1.06. The earnings had grown 7.5% a year over the prior five years, and were expected to grow 6% a year in the long term (starting in 1994). The stock had a beta of 1.05 and traded for ten times earnings. The treasury bond rate was 7%.

Estimate the P/E Ratio for National City Corporation and the long term growth rate that is implied in the firm's current P/E ratio.

Section C (4 Mark)

United Healthcare, a health maintenance organization, is expected to have high earning growth for the next five years and 6% after that. The dividend payout ratio will be only 10% during the high growth phase, but will increase to 60% in steady state. The return on equity was 21% in the most recent time period and is expected to stay at that level for the next 5 years. The stock has a beta of 1.65 currently, but the beta is expected to drop to 1.10 in steady state. (The treasury bill rate is 7.25%.)

Estimate the price/book value ratio for United Healthcare, given the inputs above.

Section A (1 Mark)

The concept of indemnity is based on the key principle that policyholders should be prevented from

Section B (2 Mark)

Compute YTM of a bond with par value of Rs.1000/-, carrying a coupon rate of 8% and maturing after 10 years. The bond is currently selling for Rs.850/-.

Section B (2 Mark)

A bank has a limited geographic area. It would like to diversify its loan income with loans in other market areas but does not want to actually make loans in those areas because of their limited experience in those areas. Which type of credit derivative contract would you most recommend for this situation?

Section B (2 Mark)

Lucy purchased a rental house a few years ago for $100,000. Total depreciation to date is $35,000. In the current year, she sells the house for $155,000 and pays $10,000 selling expenses. Calculate Lucy's gain on the sale.

Section C (4 Mark)

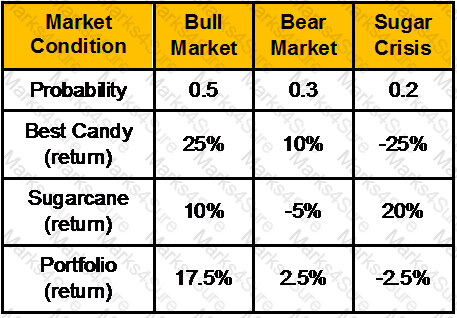

Calculate expected rate of return on the following portfolio.

Weight of X and Y in the portfolio is 50% and 50% respectively.

Section A (1 Mark)

According to behavioral finance, investors prefer dividends because:

Section B (2 Mark)

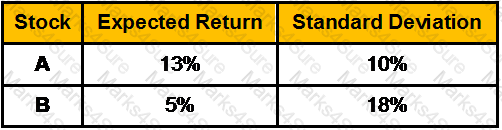

The expected returns and standard deviations of stock A and B are:

Manish buys Rs.20000 stock A and sells short Rs.10000 of stock B, using all the proceeds to buy more of stock A. The correlation between the two securities is 0.25. What are the expected return and the standard deviation of Manish’s portfolio?

Section B (2 Mark)

As Per Article 12 Double Taxation Avoidance Agreement with US, _____per cent of the gross amount of the royalties or fees for included services as defined in this Article, where the payer of the royalties or fees is the Government of that Contracting State, a political sub-division or a public sector company.

Section B (2 Mark)

Miss Femina aged 17, is married to Mr. Masculine. Her mother alone is alive income by way of interest on loans, of Miss Femina will be:-

Section A (1 Mark)

During “Building the foundation” life stage, we learn about _______

Section A (1 Mark)

The profits of a controlled foreign company which are apportioned to a UK company are charged to corporation tax at the UK company's average rate of tax.

Section A (1 Mark)

In which case, the probability of customer increases to become a defector?

Section A (1 Mark)

A bank is considering making a loan to Sumit Nayyar. Mr. Sumit has Rs 1,00,000 in the bank right now but generally keeps a balance of Rs 4,50,000 most of the year. What aspect of evaluating a consumer loan application is this fact concerned with?

Section C (4 Mark)

Read the senario and answer to the question.

Saxena bought agricultural land in notified urban limits of Mumbai on 15-June-1996 for Rs. 6 lakh and had been using the same for agricultural purposes. However the land was compulsorily acquired by the Government on 15-July-2003 and the compensation fixed was Rs. 25 lakh. Out of this, Rs 10 lakh was received by Saxena on 15-Jan-2005 and the balance on 06-Apr-2005. Saxena was not satisfied with the compensation and filed a suit in the court. The compensation was enhanced by Rs 8 lakh which was received on 25-Mar-2008. Which one of the following statement regarding capital gains arising from these transactions is correct:

Section B (2 Mark)

In 2011-12, George has property income of £8,000 and net bank interest of £4,000. He claims the personal allowance of £7,475. What is the income tax borne for the year?

Section C (4 Mark)

Mr. Peter sells a Nifty Put option with a strike price of Rs. 4000 at a premium of Rs. 21.45 and buys a further OTM Nifty Put option with a strike price Rs. 3800 at a premium of Rs. 3.00 when the current Nifty is at 4191.10, with both options expiring on 31st July.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3800

• If Nifty closes at 4500

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Saxena is planning to visit USA for the very first time in his carrier to promote software of his company and is expected to stay long. He wants to plan his journey in such a manner so that he can get maximum tax benefits in the FY 2007–08 from the residential status point of view. What is the latest date when he can afford to leave India & earn status of an NRI to get maximum tax benefits in assessment year 2008–09?

Section A (1 Mark)

A muslim gentleman can leave his will, bequeathing all his properties to someone often than his legal heirs to the extent of…………….

Section B (2 Mark)

An asset may be purchased for Rs 10,00,000. It is expected to generate Rs 10,000 annual income for 10 years after which it is expected to sell for Rs. 1,20,000. What is the rate of return expected from this investment?

Section A (1 Mark)

Which of the following measures is lowest for a currently callable bond?

Section A (1 Mark)

Which of the following is an element of an organization’s internal-environment?

Section A (1 Mark)

While matching orders for equity trading in NSE, which one of the following gets precedence over all the others?

Section A (1 Mark)

Vineet invests Rs. 5000/- per month at the beginning of the month for 10 years in Recurring Deposit account that pays 8.5% p.a interest compounded quarterly. What will be the accumulated amount in his account.

Section A (1 Mark)

Operational customer relationship management supports which of the following function?

Section C (4 Mark)

Rhona has a daughter Zena five years old. She wants to plan for Zena’s education and has found out that she would be requiring 2,75,000 at her age 18 and another 4,50,000 on her age 25. She also wants to have Rs. 10,00,000 for Zena’s Marriage which she expects at the age of 28. She wants to deposit the entire amount for these expenses today in an account that pays a ROI of 15% per annum compounded annually. What would this amount be?

Section B (2 Mark)

Amount of liability of payment of gratuity is calculated at the rate of

Section C (4 Mark)

Allianz is a number one accredited institute for the Engineering in New Delhi. It pays dividend per share of Rs. 0.24 on reported earning per share of Rs. 0.512 in 2007. The firms earnings per share have grown at 8% over the prior 5 year but that growth rate is expected to decline linearly over the next 5 years to 3%, while the payout ratio remains unchanged. The beta for the stock is 0.9. The risk free rate is 4.2% and the market risk premium is 4%.Calculate the price of the stock.

Section A (1 Mark)

Which one of the above statements is/are not a important needs of clients in the context of relationship management:

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the return on Jogen’s investments in SBI Ltd shares.

Section A (1 Mark)

According to Michael Porter, there are five determinants of competition. An example of _____ is when new entrants to an industry our pressure on prices and profits.

Section A (1 Mark)

Which of the following is not true with respect to H model of equity valuation?

Section A (1 Mark)

Mr. Kashyap took a business premise on lease with the provision that he himself had to pay the insurance premium for fire and other perils on the premises and not the owner of the premises. This would be an instance of_______________ on the part of owner of the premises.

Section B (2 Mark)

Which one of the above statements is/are not a important needs of clients in the context of relationship management?

Section C (4 Mark)

Read the senario and answer to the question.

Which of the following would affect Net Worth of Keshav?

Section A (1 Mark)

Income from which trust is added to the beneficiary’s taxable income?

Section A (1 Mark)

_______________ is concerned with capturing, storing, extracting, integrating, processing, interpreting, distributing, using and reporting customer-related data to enhance both customer and company value.

Section A (1 Mark)

CRM as a discipline that depends on people, process, information and __________

Section B (2 Mark)

A property has 120 rooms and each room has a monthly rent of Rs.750. The occupancy rate throughout the year is 80% and maintenance expenses per year works out to be Rs.3,00,000. Capitalization rate is 12%. Calculate the value of the property.

Section A (1 Mark)

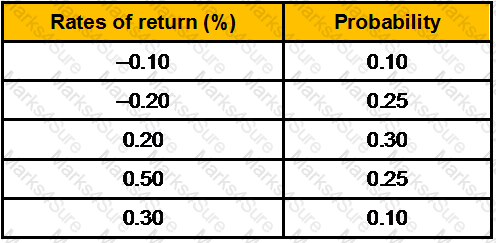

Given below is the portfolio return; calculate the expected portfolio rate of return:

Section C (4 Mark)

Puspinder Singh Ahluwalia took a housing loan on 1st. of June 2009 (EMI in arrear) of Rs. 50 lacs at a ROI of 10.75% p.a. compounded monthly for 12 years. He wants to know the deduction in taxable income he can claim u/s 24 of the IT act for the FY 2011 -12

Section A (1 Mark)

Which of the following is the fastest growing source of revenue for state and local governments in US?

Section A (1 Mark)

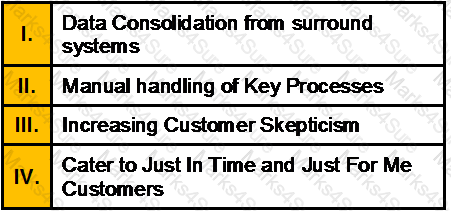

Which of the following is/are the challenges of Private Banking?

Section A (1 Mark)

An agreement entered into between the owner of the vacate land and the builder/ developer is known ____________.

Section A (1 Mark)

Mr. Sharma invested Rs. 2,00,000 in an investment that gives Rs 40,000/- for the first 4 years, and Rs. 60,000/- for next 3 years. If the discount rate is 12 %, calculate the Present Value of these cash flows?

Section A (1 Mark)

Income accruing in Sri Lanka and received there is taxable in India in case of

Section B (2 Mark)

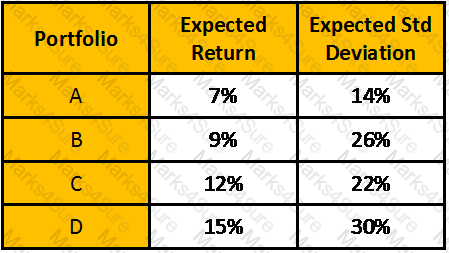

Which of the following portfolios falls below the Markowitz Efficient Frontier?

Section A (1 Mark)

………………………arises by operation of law eg trust created under MWP Act

Section C (4 Mark)

A Portfolio manager is holding the following portfolio:

The risk free rate of return is 6% and the portfolio’s required rate of return is 12.5%. The manager would like to sell all of his holdings in stock A and use the proceeds to purchase more shares of stock D. What would be the portfolio’s required rate of return following this change?

Section C (4 Mark)

Suppose Nifty is at 4500 in May. An investor, Mr. A, executes a Long Strangle by buying a Rs. 4300 Nifty Put for a premium of Rs. 23 and a Rs 4700 Nifty Call for Rs 43.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 4232

• If Nifty closes at 5241

Section A (1 Mark)

When markets are in equilibrium, the CML will be upward sloping

Section A (1 Mark)

Under Nayak Committee Method the gross working capital is uniformly assumed to be a minimum of ________ of projected gross sales

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the tax liability of Mr. Neeraj for the A.Y.08–09 assuming that he has avail full deduction under section 80C

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Technical Fees in UK is charged at:

Section B (2 Mark)

Which of the following statements with respect to DTAA is/are correct?

Section A (1 Mark)

Short-term capital gain arising for the transfer of equity shares and units of equity oriented fund shall be taxable

Section A (1 Mark)

In traditional approach to client servicing ,product offers were determined prior to analysis of client needs where as in Need Based approach a firm looks at book of business, and existing and targeted clients to assess its own core competencies and offerings

Section C (4 Mark)

Read the senario and answer to the question.

What amount he would have piled up at the end of the 20 years if it earns 8.5% compounded interest and discontinues making deposits after 9th deposit?

Section B (2 Mark)

Mr. A gifted debenture of Rs. 100000 to his wife. She received Rs. 10000 interest which she reinvests and earns Rs. 1000. This Rs. 1000 will be taxable in the hands of

Section C (4 Mark)

Your broker recommends that you purchase XYZ Inc. at Rs.60. The stock pays a Rs.2.40 dividend which (like its per share earnings) is expected to grow annually at 8 percent. If you want to earn 12 percent on your funds, is this a good buy?

Section A (1 Mark)

Financial Gerontology tries to assess client needs based on __________

Section B (2 Mark)

Consider the single factor APT. Portfolio A has a beta of 0.2 and an expected return of 13%. Portfolio B has a beta of 0.4 and an expected return of 15%. The risk-free rate of return is 10%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio _________ and a long position in portfolio _________.

Section C (4 Mark)

Azhar deposits Rs. 12,500 in an account that pays a ROI of 20% p.a compounded annually on 5th. Of March 2010. Calculate the date on which the balance in his account would be Rs.35,338/-

Section B (2 Mark)

The Motor Vehicle Insurance Policy has inbuilt cover for death/disability of driver/owner caused by accident during the use of the insured motor vehicle up to Rs. __________ in case of car/commercial vehicle and Rs. _________ in case of two wheelers.

Section A (1 Mark)

Which one of the following has not caused the huge growth in hedge funds and private equity?

Section B (2 Mark)

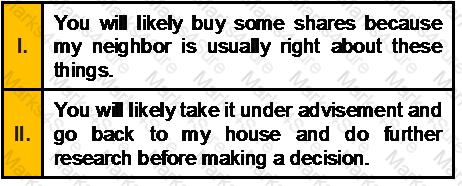

Suppose you have some money to invest and you hear about a great stock tip from your neighbor who is known to have a good stock market sense. He recommends you purchase shares in Petrolite, a company that makes a new kind of lighter fluid for charcoal grills.

What is your response to this situation if you exhibit Availability bias?

Section A (1 Mark)

Statman (1977) argues that ________ is consistent with some investors' irrational preference for stocks with high cash dividends and with a tendency to hold losing positions too long.

Section C (4 Mark)

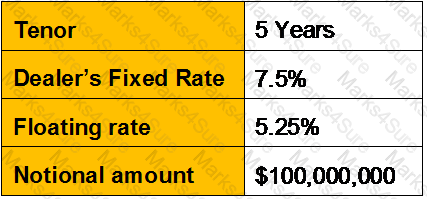

Assume the following;

With this agreement, every 6 months, the transfer of funds takes place between fixed rate payer and floating rate payer.

What would Net Cash flows after 6-months from the initiation date?

Section A (1 Mark)

A(n)____________________________________________ is where the customer can use the difference between some percentage of the appraised value of their home and the mortgage remaining to secure a loan. This loan can be used to fund a college education, pay for a vacation or pay for home improvements.

Section B (2 Mark)

Investors will choose investments that resonate with their own personality or that have characteristics that investors can relate to their own behavior. Taking the opposite view, investors ignore potentially good investments because they can’t relate to or do not come in contact with characteristics of those investments. For example, thrifty people may not relate to expensive stocks (high price/earnings multiples) and potentially miss out on the benefits of owning these stocks.

Which of the following Availability Bias have been exhibited in the case above?

Section A (1 Mark)

Which one of the following definitions of hedge fund strategies is not correct?

Section B (2 Mark)

The price of Sunder Ltd. is currently Rs. 40. The dividend next year is expected to be Rs. 4. Required return on the stock is 12%. Find the expected growth rate under the constant growth model.