Holding cash in excess of business requirements rather than returning the cash to shareholders is most likely to result in lower:

If a company's bonds are currently yielding 8% in the marketplace, why would the entity's cost of debt be lower than this?

A company has some 7% coupon bonds in issue and wishes to change its interest rate profile.

It has decided to do this by entering into a plain coupon interest rate swap with it's bank.

The bank has quoted a swap rate of: 6.0% - 6.5% fixed against LIBOR.

What will the company's new interest rate profile be?

A listed company in a high growth industry, where innovation is a key driver of success has always operated a residual dividend policy, resulting in volatility in dividends due to periodic significant investments in research and development.

The company has recently come under pressure from some investors to change its dividend policy so that shareholders receive a consistent growing dividend. In addition, they suggested that the company should use more debt finance.

If the suggested change is made to the financial policies, which THREE of the following statements are true?

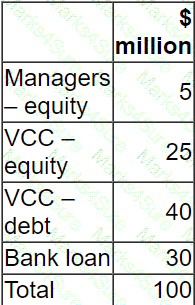

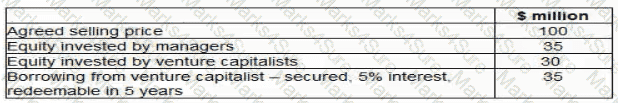

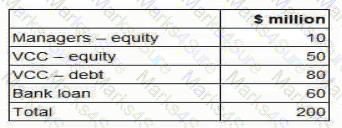

A company intends to sell one of its business units, Company R by a management buyout (MBO).

A selling price of $100 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal:

The VCC requires a minimum return on its equity investment in the MBO of 30% a year on a compound basis over 5 years.

What is the minimum TOTAL equity value of Company R in 5 years time in order to meet the VCC's required return?

Give your answer to one decimal place.

$ ? million

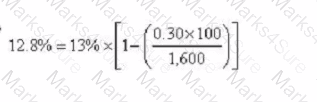

CAPM:

E(R)=Rf+β(Rm−Rf)E(R) = R_f + \beta (R_m - R_f)E(R)=Rf+β(Rm−Rf)

Given:

E(R)=11%,Rf=2%,Rm=8%E(R) = 11\% , R_f = 2\%, R_m = 8\%E(R)=11%,Rf=2%,Rm=8%

0.11=0.02+β(0.08−0.02)⇒0.11−0.02=0.06β⇒0.09=0.06β⇒β=1.50.11 = 0.02 + \beta(0.08 - 0.02) \Rightarrow 0.11 - 0.02 = 0.06\beta \Rightarrow 0.09 = 0.06\beta \Rightarrow \beta = 1.50.11=0.02+β(0.08−0.02)⇒0.11−0.02=0.06β⇒0.09=0.06β⇒β=1.5

Beta > 1 ⇒ higher risk than the market.

Listed Company A has prepared a valuation of an unlisted company. Company B. to achieve vertical integration Company A is intending to acquire a controlling interest in the equity of Company B and therefore wants to value only the equity of Company B.

The assistant accountant of Company A has prepared the following valuation of Company B's equity using the dividend valuation model (DVM):

Where:

• S2 million is Company B's most recent dividend

• 5% is Company B's average dividend growth rate over the last 5 years

• 10% is a cost of equity calculated using the capital asset pricing model (CAPM), based on the industry average beta factor

Which THREE of the following are valid criticisms of the valuation of Company B's equity prepared by the assistant accountant?

A company is financed as follows:

• 400 million $1 shares quoted at $3.00 each.

• $800 million 5% bonds quoted at par.

The company plans to raise $200 million long term debt to finance a project with a net present value of $100 million.

The bank that is providing the debt is insisting on a maximum gearing level covenant.

Gearing will be based on market values and calculated as debt/(debt + equity).

What is the lowest figure for the gearing covenant that the bank could impose without the company breaching the agreement?

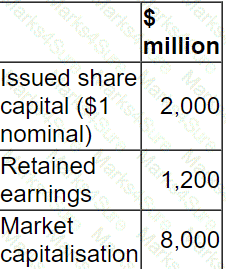

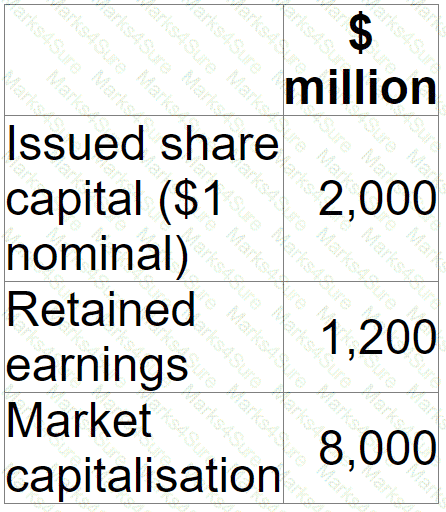

A listed company is financed by debt and equity.

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

XYZ is a multi-national group with subsidiary AA in Country A and subsidiary BB in Country B. The capital structures of AA and BB are set up to take advantage of the lower tax rate in Country A Thin capitalisation rules in Country B will limit the ability for either AA or BB to claim tax relief on:

Company A operates in country A with the AS as its functional currency. Company A expects to receive BS500.000 in 6 months' time from a customer in Country B which uses the B$.

Company A intends to hedge the currency risk using a money market hedge

The following information is relevant:

What is the AS value of the BS expected receipt in 6 months' time under a money market hedge?

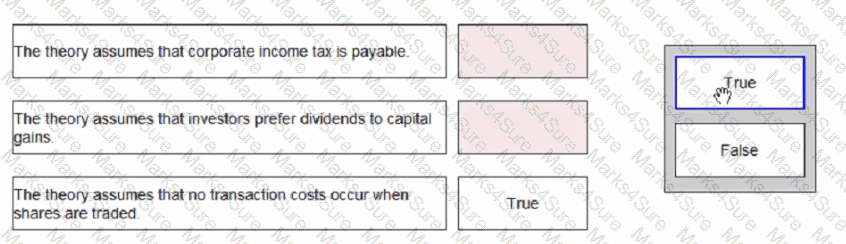

Select whether the following statements are true or false with regard to Modigliani and Miller's dividend policy theory.

A company plans to raise finance for a new project.

It is considering either the issue of a redeemable cumulative preference share or a Eurobond.

Advise the directors which of the following statements would justify the issue of preference shares over a bond?

An unlisted company is attempting to value its equity using the dividend valuation model.

Relevant information is as follows:

• A dividend of $500,000 has just been paid.

• Dividend growth of 8% is expected for the foreseeable future.

• Earnings growth of 6% is expected for the foreseeable future.

• The cost of equity of a proxy listed company is 15%.

• The risk premium required due to the company being unlisted is 3%.

The calculation that has been performed is as follows:

Equity value = $540,000 / (0.18 - 0.08) = $5,400,000

What is the fault with the calculation that has been performed?

LPM Company is based in Country C. whose currency is the CS

It has entered Into a contract to buy a machine in three months' time. The supplier is overseas and the payment is to be made in a different currency from the CS

The treasurer at LPM Company is considering using a money market hedge to manage the transaction risk associated with a payment.

The assumptions of interest rate parity apply

Which THREE of the following statements concerning the use of a money market hedge for this supplier payment are correct?

SUP is a large supermarket chain. It produces many 'own brand' goods in Country S where the parent company is located. These goods are sold in SUP's supermarkets in Country S as well as being sold at a 'transfer price' to SUP companies located in foreign countries for sale in the SUP supermarkets located in that country.

Which of the following factors is the most important for SUP from a lax planning and compliance viewpoint when setting prices for the 'own brand' goods sold to other group companies'?

A company needs to raise $20 million to finance a project.

It has decided on a rights issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $5 per share.

Calculate the terms of the rights issue.

In the context of the Integrated Reporting

Company A is subject to a takeover bid from Company B, both companies operate in the same industry and each of them demand a significant market share Company B h3S made an of an of $5 per share to the shareholders of Company A.

The directors of Company A do not believe the takeover would be in the best interests of the stakeholders and other stakeholders of Company A due to the following reruns

1. Company B has recently taken ever several ether companies resulting in them breaking up the company and se ling on the assets.

2 The directors of Company A believe the offer of $5 per snare undervalues tie company

The directors of Company A are therefore keen to prevent the bid from going ahead

Which THREE of the following defence strategies could be used by the directors of Company Air this situation?

A company is valuing its equity prior to an initial public offering (IPO).

Relevant data:

• Earnings per share $1.00

• WACC is 8% and the cost of equity is 12%

• Dividend payout ratio 40%

• Dividend growth rate 2% in perpetuity

The current share price using the Dividend Valuation Model is closest to:

Company YZZ has made a bid for the entire share capital of Company ZYY

Company YZZ is offering the shareholders in Company ZYY the option of either a share exchange or a cash alternative

Which THREE of the following would be considered disadvantages of accepting the cash consideration for the shareholders of Company ZYY?

A company which is forecast to experience a strong growth in its profitability is evaluating a potential bond issue.

Which of the following changes in corporate income tax and in bond yields would make the bond issue more attractive to the company?

Company A plans to acquire a minority stake in Company B.

The last available share price for Company B was $0.60.

Relevant data about Company B is as follows:

• A dividend per share of $0.08 has just been paid

• Dividend growth is expected to be 2%

• Earnings growth is expected to be 4%

• The cost of equity is 15%

• The weighted average cost of capital is 13%

Using the dividend growth model, what would be the expected change in share price?

ADC is planning to acquire DEF in order to benefit from the expertise of DEF's owner ‘managers Both are Listed companies. ADC is trying to decide whether to offer cash or shares in consideration for DEF's shares.

Which THREE of the following are advantages to ABC of offering shares to acquire CEF?

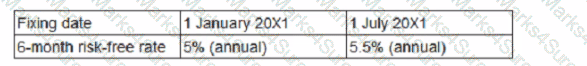

On 1 January 20X1 a company entered into a S200 million interest rate swap with a bank at a fixed rate of 4% against the 6-month risk-free rate to hedge the interest rale risk on a floating rate borrowing.

6-month risk-free rate was as follows:

What is the net settlement due under the swap contract on 1 July 20X1?

HHH Company has a fixed rate loan at 10.0%, but wishes to swap to variable. It can borrow at the risk-free rate +8%. The bank is currently quoting swap rates of 3.1% (bid) and 3.5% (ask). What net rate will HHH Company pay if it enters into the swap?

Company A has agreed to buy all the share capital of Company B.

The Board of Directors of Company A believes that the post-acquisition value of the expanded business can be computed using the "boot-strapping" concept.

Which of the following most accurately describes "boot-strapping" in this context?

Company A is a listed company that produces pottery goods which it sells throughout Europe. The pottery is then delivered to a network of self employed artists who are contracted to paint the pottery in their own homes. Finished goods are distributed by network of sales agents.The directors of Company A are now considering acquiring one or more smaller companies by means of vertical integration to improve profit margins.

Advise the Board of Company A which of the following acquisitions is most likely to achieve the stated aim of vertical integration?

A company is planning a share buyback. In which of the following circumstances would a share buyback be appropriate?

Where a company acquires another company, which THREE of the following offer the greatest potential for enhancing shareholder wealth?

A large, quoted company that is all-equity financed is planning to acquire a smaller unquoted company that is also all-equity financed.

The acquiring company's directors are using the dividend valuation model to value the target company before making an offer.

Relevant data for the target company:

• Dividends paid in the last financial year $2 million

• Book value of net assets $15 million

• Shares in issue 1 million

The acquiring company's cost of capital is 10%.

Its directors believe they can improve the target company's performance in the long term.

They estimate there will be no growth in the first year of the acquisition but from year 2 onwards there will be a 4% growth each year in perpetuity.

What is the maximum price the acquiring company should offer for each of the shares in the target company?

A company is planning to issue a 5 year $100 million bond at a fixed rate of 6%.

It is also considering whether or not to enter into a 10 year $100 million swap to receive 5% fixed and pay Libor + 1% once a year.

The company predicts that Libor will be 4% over the life of the 5 years.

What is the impact of the swap on the company's annual interest cost assuming that the Libor prediction is correct?

Which of the following statements about companies seeking a stock market listing is correct?

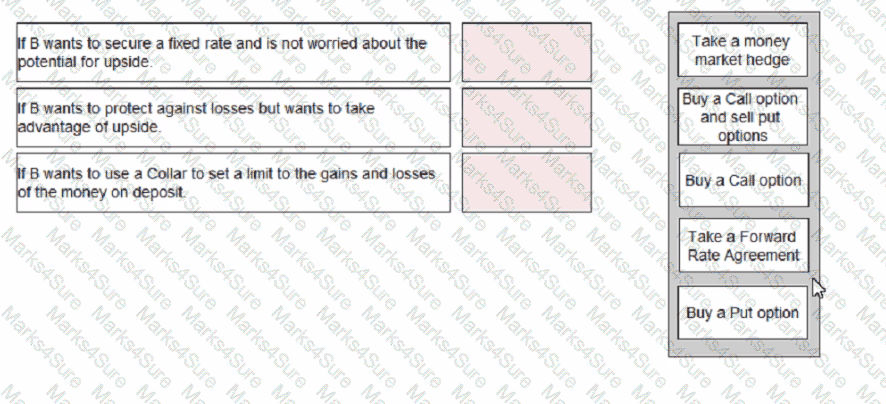

B, a European based modern art dealer, frequently imports and sells single high value items created in the United States. The price is fixed at the date of sale but the items are commissioned and made to order with a lead time of three to nine months depending on the individual specification

B holds payment for his customers from the point of purchase and passes funds when the items are shipped However, despite putting the money on short term deposit, there have been times when B's profits have been almost entirely eroded by adverse movements m interest rates Advise B by matching the appropriate instrument to B's requirements.

VVV has a floating rate loan that it wishes to replace with a fixed rate. The cost of the existing loan is the risk-free rate + 3%. VW would have to pay a fixed rate of 7% on a fixed rate loan VVVs bank has found a potential counterparty for a swap arrangement.

The counterparty wishes to raise a variable rate loan It would pay the risk-free rate +1 % on a variable rate loan and 8% on a fixed rate.

The bank will require 10% of the savings from the swap and WV and the counterparty will share the remaining saving equally.

Calculate VWs effective rate of interest from this swap arrangement.

Company AB was established 6 years ago by two individuals who each own 50% of the shares.

Each individual heads a separate division within the company, which now has annual turnover of GBP10 million and employs 40 people.

Some of the employees are very highly paid as they are important contributors to the company's profitability.

The owners of the company wish to realise the full value of their investment within the next 12 months.

Which TWO of the following options are most likely to be acceptable exit strategies to the two owners of the company?

A young, capital intensive company has a large amount of tangible assets.

Intangibles, including brand name, are considered to be of negligible value at this time

Relevant data:

• The company operates a residual dividend policy.

• The industry in which the company operates is suffering from a large amount of uncertainty at present. Forecasting the future earnings or cashflows of the company is therefore extremely difficult

• There are very few quoted companies in the industry that are similar in size or in precisely the same business sectors.

Which method of valuation would be most suitable for this company?

A company is considering whether to lease or buy an asset.

The following data applies:

• The bank will charge interest at 7.14% per annum

• The asset will cost $1 million

• Tax-allowable depreciation is available on a straight line basis over 5 years

• There is no residual value

• Corporate tax is paid at 30% in the year when the profit is earned

What is the NPV of the buy option?

Give your answer to the nearest $000.

$ ?

A large multi-divisional company in the food processing and distribution business is conducting a strategic review. The divisions all compete in the same market.

The sale of one of its underperforming food processing divisions to the divisional management team is currently being considered. The purchase by the divisional management team will require venture capital finance.

Which THREE of the following are likely to influence the multi-divisional company's decision on whether or not to sell the under-performing division to the management team?

Under traditional theory, an increase in a company's WACC would cause the value of the company to:

A company is planning a share repurchase programme with the following details:

• Repurchased shares will be immediately cancelled.

• The shares will be purchased at a premium to the market share price.

The current market share price is greater than the nominal value of the shares.

Which of the following statements about the impact of the share repurchase programme on the company's financial statements is correct?

A company needs to raise $20 million to finance a project.

It has decided on a rights issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $5 per share.

Calculate the terms of the rights issue.

Which TWO of the following situations offer arbitrage opportunities?

A)

B)

C)

D)

A is a listed company. Its shares trade on a stock market exhibiting semi-strong form efficiency.

Which of the following is most likely to increase the wealth of A's shareholders?

A company has an opportunity to invest in a positive net present value project, but the project would require debt finance that would push the company's gearing ever a limit imposed by a debt covenant on an existing loan.

Which THREE of the following actions could be taken by the company?

Company Z has identified four potential acquisition targets: companies A, B, C and D.

Company Z has a current equity market value of $580 million.

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?

Company U has made a bid for the entire share capital of Company B.

Company U is offering the shareholders in Company B the option of either a share exchange or a cash alternative.

Advise the shareholders in Company B which THREE of the following would be considered disadvantages of accepting the cash consideration?

An all-equity financed company currently generates total revenue of $50 million.

Its current profit before interest and taxation (PBIT) is $10 million.

Due to difficult trading conditions, the company expects its total revenue to be constant next year, although some margins will reduce.

It forecasts next year's PBIT will fall to 18% on 40% of its revenue, but that the PBIT on the other 60% of its revenue will be unaffected.

The rate of corporate tax is 20%.

What is the forecast percentage reduction in next year's Earnings?

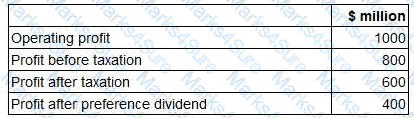

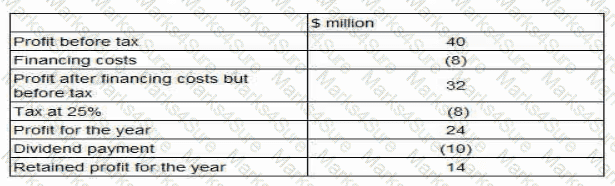

Extracts from a company's profit forecast for the next financial year is as follows:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 2,000 million ordinary shares currently in issue and cancelling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

A financial services company reported the following results in its most recent accounting period:

The company has an objective to achieve 5% earnings growth each year. The directors are discussing how this objective might be achieved next year.

Revenues have been flat over the last couple of years as the company has faced difficult trading conditions. Revenue is expected to stay constant in the coming year and so the directors are focussing efforts on reducing costs in an attempt to achieve earnings growth next year.

Interest costs will not change because the company's borrowings are subject to a fixed rate of interest.

What operating profit margin will the company have to achieve next year in order to just achieve its 5% earnings growth objective'?

Company A is a large listed company, with a wide range of both institutional and private shareholders.

It is planning a takeover offer for Company B.

Company A has relatively low cash reserves and its gearing ratio of 40% is higher than most similar companies in its industry.

Which TWO of the following would be the most feasible ways of Company A structuring an offer for Company B?

A company with a market capitalisation of S50million is considering raising $1 million debt to fund a new 10-year capital investment protect

The value of this issue is considered to be small in comparison to the company's market capitalisation

The company is considering whether to raise the debt finance by either a "bond private placing' or a 'public bond issue.

Which THREE of the following statements are correct?

A listed entertainment and media company produces and distributes films globally. The company invests heavily in intellectual property in order to create the scope for future film projects. The company has five separate distribution companies, each managed as a separate business unit The company is seeking to sell one of its business units in a management buy-out (MBO) to enable it to raise finance for proposed new investments

The business unit managers have been in discussions with a bank and venture capitalists regarding the financing for the MBO The venture capitalists are only prepared to invest a mixture of debt and equity and have suggested the following:

The venture capitalists have stated that they expect a minimum return on their equity investment of 3Q°/o a year on a compound basis over the first 5 years of the MBO No dividends will be paid during this period.

Advise the MBO team of the total amount due to the venture capitalist over the 5-year period to satisfy their total minimum return?

A project requires an initial outlay of $2 million which can be financed with either a bank loan or finance lease.

The company will be responsible for annual maintenance under either option.

The tax regime is:

• Tax depreciation allowances can be claimed on purchased assets.

• If leased using a finance lease, tax relief can be claimed on the interest element of the lease payments and also on the accounting depreciation charge.

The trainee management accountant has begun evaluating the lease versus buy decision and has produced the following data. He is not confident that all this information is relevant to this decision.

Using only the relevant data, which of the following is correct?

A company is currently all-equity financed.

The directors are planning to raise long term debt to finance a new project.

The debt:equity ratio after the bond issue would be 30:60 based on estimated market values.

According to Modigliani and Miller's Theory of Capital Structure without tax, the company's cost of equity would:

A listed company plans to raise $350 million to finance a major expansion programme.

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of 3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

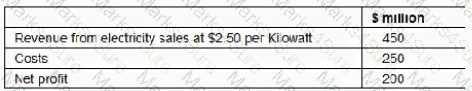

A company generates and distributes electricity and gas to households and businesses.

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $1.50 per Kilowatt.

The company expects this to cause consumption to rise by 10% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

A company has identified potential profitable investments that would require a total of S50 million capital expenditure over the next two years The following information is relevant.

• The company has 100 million shares in issue and has a market capitalisation of S500 million

• It has a target debt to equity ratio of 40% based on market values This ratio is currently 30%

• Earnings for the current year are expected to be S1 00 million

• Its last dividend payment was $1 per share One of the company's objectives is to increase dividends by at least 10% each year

• The company has no cash reserves

Which of the following is the most suitable method of financing to meet the company's requirements?

Company A is based in Country A where the functional currency is the A$. Currently all sales are to domestic customers in Country A. However, the company is planning to expand internationally by acquiring Company B, a distribution company in Country B, to enable it to sell goods worldwide The functional currency of Country B is the BS

Company A will invoice its international customers in their local currency.

Wage increases in Country B are forecast to be modest, due to high unemployment levels, but overall inflation in Country B is forecast to be significantly higher than in Country A

Which TWO of the following statements about the economic risk of the acquisition of Company B are true?

Which of the following statements are true with regard to interest rate swaps?

Select ALL that apply.

A listed company has recently announced a profit warning.

The company's share price fell 20% on the day of the announcement but had been fairly static in the weeks leading up to the announcement.

Which form of efficient market is most likely to be indicated by this share price movement?

A company is currently all-equity financed with a cost of equity of 9%.

It plans to raise debt with a pre-tax cost of 3% in order to buy back equity shares.

After the buy-back, the debt-to-equity ratio at market values will be 1 to 2.

The corporate income tax rate is 25%.

Which of the following represents the company's cost of equity after the buy-back according to Modigliani and Miller's Theory of Capital Structure with taxes?

PYP is a listed courier company. It is looking to raise new finance to fit each of its delivery vans with new equipment to allow improved parcel tracking for customers The senior management team of PYP have decided on a 10-year secured bond to finance this investment-

Which TWO of the following variables are most likely to decrease the yield to maturity of the bond?

A listed company is considering either a one-off special divided or a share repurchase scheme to reduce its surplus cash level.

Identify TWO advantages that a one-off special payment has over a share repurchase scheme.

A venture capitalist invests in a company by means of buying:

• 9 million shares for $2 a share and

• 8% bonds with a nominal value of $2 million, repayable at par in 3 years' time.

The venture capitalist expects a return on the equity portion of the investment of at least 20% a year on a compound basis over the first 3 years of the investment.

The company has 10 million shares in issue.

What is the minimum total equity value for the company in 3 years' time required to satisify the venture capitalist's expected return?

Give your answer to the nearest $ million.

$ million.

Providers of debt finance often insist on covenants being entered into when providing debt finance for companies.

Agreement and adherence to the specific covenants is often a condition of the loan provided by the lender.

Which THREE of the following statements are true in respect of covenants?

A company wishes to raise new finance using a rights issue. The following data applies:

• There are 20 million shares in issue with a market value of $6 each

• The terms of the rights will be 1 new share for 4 existing shares held

• After the rights issue, the theoretical ex-rights price (TERP) will be $5.75

Assuming all shareholders take up their rights, how much new finance will be raised ?

Give your answer to one decimal place.

$ ? million

A company is planning a new share issue.

The funds raised will be used to repay debt on which it is currently paying a high interest rate.

Operating profit and dividends are expected to remain unchanged in the near future.

If the share issue is implemented, which THREE of the following are most likely to increase?

Using the CAPM, the expected return for a company is 10%. The market return is 7% and the risk free rate is 1%.

What does the beta factor used in this calculation indicate about the risk of the company?

The Board of Directors of Company T is considering a rights issue to fund a new investment opportunity which has a zero NPV.

The Board of Directors wishes to explain to shareholders what the theoretical impact on their wealth will be as a result of different possible actions during the rights issue.

Which THREE of the following statements in respect of theoretical shareholder wealth are true?

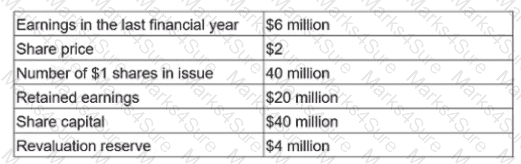

An unlisted company has the following data:

A listed company in the same industry has a P/E of 11.

The value of the unlisted company based on the P/E of this listed company is:

Give your answer to the nearest whole number.

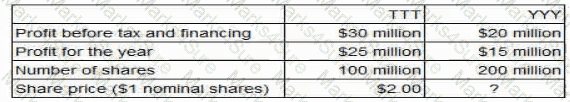

Two unlisted companies TTT and YYY are being valued. The companies have similar capital structures and risk profiles and operate in the same industry sector It is easier to value TTT than to value YYY because there have recently been several well-publicised private sales of TTT shares.

Relevant company data:

What is the best estimate of YYY's share price?

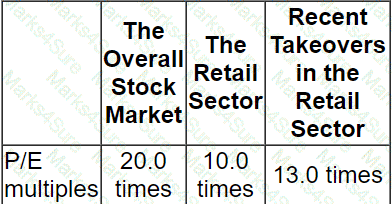

Company T is a listed company in the retail sector.

Its current profit before interest and taxation is $5 million.

This level of profit is forecast to be maintainable in future.

Company T has a 10% corporate bond in issue with a nominal value of $10 million.

This currently trades at 90% of its nominal value.

Corporate tax is paid at 20%.

The following information is available:

Which of the following is a reasonable expectation of the equity value in the event of an attempted takeover?

A company is preparing an integrated report according to the International

Which THREE of the following should be included in the report?

PPA owns $500,000 of shares in Company ABB. Company ABB has a daily volatility of 2% of its share price

Calculate the 12-day value at risk that shows the most PPA can expect to lose during a 12-day period (PPA wishes to be 90% certain that the actual loss in any month will be less than your predicted figure)

Give your answer to the nearest thousand dollars.

A company raised fixed rate bank finance together with an interest rate swap for the same term and same principal value to pay floating receive fixed rate interest on an annual basis.

Which THREE of the following statements are correct?

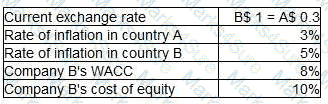

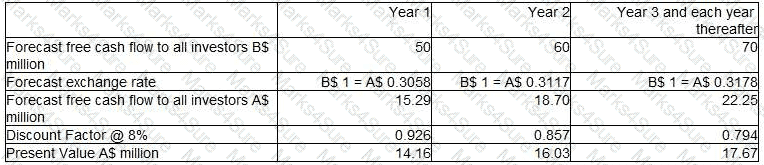

Company A operates in country A and uses currency AS. It is looking to acquire Company B which operates in country B and uses currency B$. The following information is relevant:

The assistant accountant at Company A has prepared the following valuation of company B's equity, however there are some errors in his calculations.

Value of Company B's equity = 14.16 + 16.03 + 17.67 = AS47.86 million

Company B has BS5 million of debt finance.

Which of the following THREE statements are true?

A private company was formed five years ago and is currently owned and managed by its five founders. The founders, who each own the same number of shares have generally co-operated effectively but there have also been a number of areas where they have disagreed

The company has grown significantly over this period by re-investing its earnings into new investments which have produced excellent returns

The founders are now considering an Initial Public Offering by listing 70% of the shares on the local stock exchange

Which THREE of the following statements about the advantages of a listing are valid?

A listed company is planning a share repurchase.

The following data applies

• There are 20 million shares in issue

• The share repurchase will involve buying back 10% of the shares at a price of $1.20

• The company is holding $4.8 million cash

• Earnings for the current year ended are $3.6 million

The Directors are concerned about the impact that this repurchase programme will have on the company's cash balance and current year earnings per share (EPS) ratio.

Advise the directors which of the following statements is correct?

Which THREE of the following statements are correct in respect of the issuance of debt securities.

B has a S3 million loan outstanding on which the interested rate is reset every 6 months for the following 6 month and the interested is payable at the end of that 6 month period. The next 6 monthly reset period starts in 3 months and the treasurer of B thinks interested rates are likely to raise between and then.

Current 6-month rates are 6.4% and the treasurer can get a rate of 6.9% for a 6-month forward rate agreement (FRA) starting in 3 months time. By transacting an TRA the treasurer can lock in a rate today of 6.9%.

If interested rates are 7.5% in 3 months’ time, what will the net amount payable be?

Give your answer to the nearest thousand dollars.

The directors of a financial services company need to calculate a valuation of their company’s equity in preparation for an upcoming initial Public Offering (IPO) of shares. At a recent board meeting they discussed the various methods of business valuation.

The Chief Executive suggested using a Price-earing (P./E) method of valuation, but the finance Director argued that a valuation based on forecast cash flows to equity would be more appropriate.

Which THREE of the following are advantages of valuation based on forecast cash flows to equity, compared to a valuating using a price earnings methods?

A company based in the USA has a substantial fixed rate borrowing at an interest rate of 3.5% and wishes to swap a part of this to a floating rate to take advantage of reducing interest rates Its bank has quoted swap rates of 3 4%-3 5% against 12-month USD risk-free rate.

What is the overall interest rate achieved by the company under this borrowing plus swap combination?

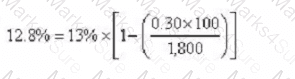

Company M is a geared company whose equity has a market value of $1,500 million and debt has a market value of S300 million. The company plans to issue $200 million of new shares and use the funds raised to pay off some of the debt

Company M currently has a cost of equity of 13% and a WACC of 10% It pays corporate tax at the rate of 30% Company B, an ungeared company operating in the same business sector as Company M, has a cost of equity of 12%

Assume Modigliani and Miller's theory of capital structure with tax applies

Which calculation below shows the correct approach to calculating the new WACC following the planned changes in capital structure?

A

B

C

D

Company Y plans to diversify into an activity where Company X has an equity beta of 1.6, a debt beta of zero and gearing of 50% (debt/debt plus equity).

The risk-free rate of return is 5% and the market portfolio is expected to return 10%.

The rate of corporate income tax is 30%.

What would be the risk-adjusted cost of equity if Company Y has 60% equity and 40% debt?

Which three of the following are most likely be primary objectives for a newly established, unincorporated entity in the service sector?

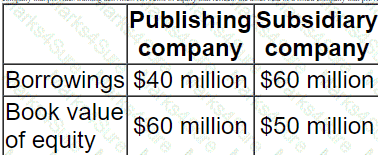

A listed publishing company owns a subsidiary company whose business activity is training.

It wishes to dispose of the subsidiary company.

The following information is available:

The board of the publishing company believe that the value of the subsidiary company, and hence the value of the equity invested in it, can be determined by calculating the present value of the subsidiary's free cashflows.

Which of the following is the most appropriate discount rate to use when determining the enterprise value of the company?

A company intends to sell one of its business units. Company W, by a management buyout (MBO). A selling price of S200 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal.

The VCC requires a minimum return on its equity investment In the MBO of 35% a year on a compound basis over 5 years. What is the minimum total equity value of Company W in 5 years time in order to meet the VCC's required return? Give your answer to one decimal place.

Company C has received an unwelcome takeover bid from Company P.

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

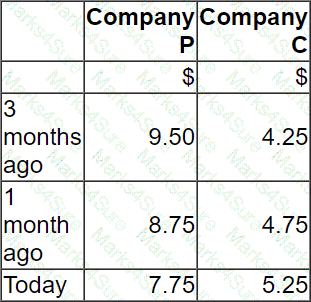

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

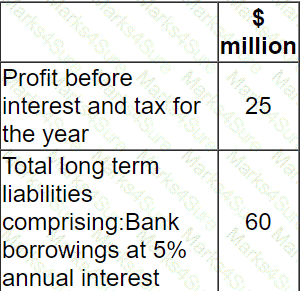

At the last financial year end, 31 December 20X1, a company reported:

The corporate income tax rate is 30% and the bank borrowings are subject to an interest cover covenant of 4 times.

The results are presently comfortably within the interest cover covenant as they show interest cover of 8.3 times. The company plans to invest in a new product line which is not expected to affect profit in the first year but will require additional borrowings of $20 million at an annual interest rate of 10%.

What is the likely impact on the existing interest cover covenant?

A company currently has a 5.25% fixed rate loan but it wishes to change the interest style of the loan to variable by using an interest rate swap directly with the bank.

The bank has quoted the following swap rate:

* 4.50% - 455% in exchange for Libor

Libor is currently 4%.

If the company enters into the swap and Libor remains at 4%. what will the company's interest cost be?

Company M is a listed company in a highly technical service industry.

The directors are considering making a cash offer for the shares in Company Q, an unquoted company in the same industry.

Relevant data about Company Q:

• The company has seen consistent growth in earnings each year since it was founded 10 years ago.

• It has relatively few non-current assets.

• Many of the employees are leading experts in their field. A recent exercise suggested that the value of the company's human capital exceeded the value of its tangible assets.

The directors and major shareholders of Company Q have indicated willingness to sell the company.

Before negotiations become too advanced, the directors of Company M are considering the benefits to their company that would follow the acquisition.

Which THREE of the following are the most likely benefits of the acquisition to Company M's shareholders?

Company A is planning to acquire Company B. Both companies are listed and are of similar size based on market capitalisation No approach has yet been made to Company B's shareholders as the directors of Company A are undecided about the most suitable method of financing the offer Two methods are under consideration a share exchange or a cash offer financed by debt.

Company A currently has a gearing ratio (debt to debt plus equity) of 30% based on market values. The average gearing ratio (debt to debt plus equity) for the industry is 50% Although no formal offer has been made there have been market rumours of the proposed bid. which is seen as favorable to Company A. As a consequence. Company As share price has risen over the past few weeks while Company B's share price has fallen.

Which THREE of the following statements are most likely to be correct?

Which THREE of the following would be of most interest to lenders deciding whether to provide long-term debt to a company?

A wholly equity financed company has the following objectives:

1. Increase in profit before interest and tax by at least 10% per year.

2. Maintain a dividend payout ratio of 40% of earnings per year.

Relevant data:

• There are 2 million shares in issue.

• Profit before interest and tax in the last financial year was $4 million.

• The corporate income tax rate is 20%.

At the beginning of the current financial year, the company raised long term debt of $2 million at 5% interest each year.

Calculate the dividend per share that will be announced this year assuming the company achieves its objective of increasing profit before interest and tax by 10%.

The International Integrated Reporting Council (IIRC) was formed in August 2010 and brings together a cross-section of representatives from a wide variety of business sectors.

The primary purpose of the IIRC's framework is to help enable an organsation to communicate how it:

A company based in Country A with the A$ as its functional currency requires A$500 million 20-year debt finance to finance a long-term investment The company has a high credit rating, but has not previously issued corporate bonds which are listed on the stock exchange Which THREE of the following are advantages of issuing 20 year bonds compared with simply borrowing for a 20 year period?

A listed company is financed by debt and equity.

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

A company's Board of Directors is considering raising a long-term bank loan incorporating a number of covenants.

The Board members are unsure what loan covenants involve.

Which THREE of the following statements regarding loan covenants are true?

A company is reporting under IFRS 7 Financial Instruments: Disclosures for the first time and the directors are concerned about whether this will lead to the disclosure of information that could affect the company's share price.

The company is based in a country that uses the A$ but 40% of revenue relates to export sales to the USA and priced in US$.

When the company reports under IFRS 7 for the first time, the share price is most likely to:

Company ABC is planning to bid for company DDD, an unlisted company in an unrelated industry sector to ABC.

The directors of ABC are considering a number of different valuation methods for DDD before making a bid.

Which of the following is the MOST appropriate method for ABC to use to value DDD?

An all equity financed company reported earnings for the year ending 31 December 20X1 of $8 million.

One of its financial objectives is to increase earnings by 5% each year.

In the year ending 31 December 20X2 it financed a project by issuing a bond with a $1 million nominal value and a coupon rate of 4%.

The company pays corporate income tax at 20%.

If the company is to achieve its earnings target for the year ending 31 December 20X2, what is the minimum operating profit (profit before interest and tax) that it must achieve?

A listed company has suffered a period of falling revenues and profit margins. It has been obliged to issue a profit warning to the market and its share price has fallen sharply. The company relies heavily on debt finance and is discussing with its banks possible refinancing options to assist with a restructuring programme.

Which THREE of the following are likely to be of MOST interest to the company's banks when they review the refinancing requests?

Company Z has just completed the all-cash acquisition of Company A.

Both companies operate in the advertising industry.

The market considered the acquisition a positive strategic move by Company Z.

Which THREE of the following will the shareholders of Company Z expect the company's directors to prioritise following the acquisition?

Company M's current profit before interest and taxation is $5.0 million.

It has a long-term 10% corporate bond in issue with a nominal value of $10 million.

The rate of corporate tax is 25%.

It plans to continue to pay out 50% of its earnings in dividends and earnings are expected to grow by 3% each year in perpetuity.

Its cost of equity is 10%.

Using the dividend growth model, advise the Board of Directors of Company M which of the following provide a reasonable valuation of Company M's equity?

A company has a covenant on its 5% long-term bond, stipulating that its retained earnings must not fall below $2 million.

The company has 100 million shares in issue.

Its most recent dividend was $0.045 per share. It has committed to grow the dividend per share by 4% each year.

The nominal value of the bond is $60 million. It is currently trading at 80% of its nominal value.

Next year's earnings before interest and taxation are projected to be $11.25 million.

The rate of corporate tax is 20%.

If the company increases the dividend by 4%, advise the Board of Directors if the level of retained earnings will comply with the covenant?

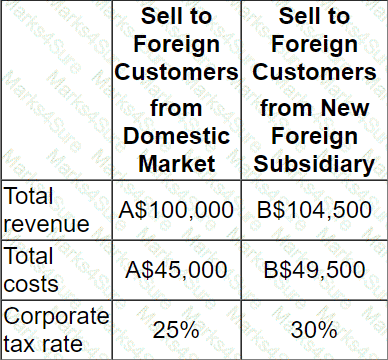

A company is considering either directly exporting its product to customers in a foreign country or setting up a subsidiary in the foreign country to manufacture and supply customers in that country.

Details of each alternative method of supplying the foreign market are as follows:

There is an import tax on product entering the foreign country of 10% of sales value.

This import duty is a tax-allowable deduction in the company's domestic country.

The exchange rate is A$1.00 = B$1.10

Which alternative yields the highest total profit after taxation?

A company plans to raise S15 million to finance an expansion project using a rights issue Relevant data

• Shares will be offered at a 20% discount to the present market price of S12 50 per share

• There are currently 3 million shares in issue

• The project is forecast to yield a positive NPV of $9 million

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

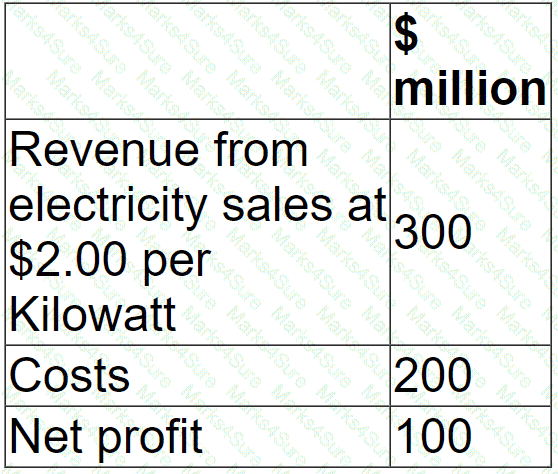

A company generates and distributes electricity and gas to households and businesses.

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $2.00 per Kilowatt.

The company expects this to cause consumption to rise by 15% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Company HJK is planning to bid for listed company BNM

Financial data for BNM for the financial year ended 31 December 20X1:

HJK is not forecasting any growth in these figures for the foreseeable future

Profit and cost data above should be assumed to be equivalent to cash flow data when answenng this question

Which THREE of the following approaches would be most appropriate for HJK to use to value the equity of BNM?

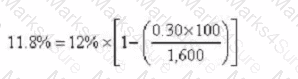

Using the CAPM, the expected return for a company is 11%. The market return is 8% and the risk free rate is 2%.

What does the beta factor used in this calculation indicate about the risk of the company?