Mr. Neeraj Gupta wants to withdraw Rs. 50,000 per quarter form an account after 3 years for 6 years. How much should he deposit in this account today if the ROI is 12% p.a. compounded quarterly.?

Ramesh aged 50 could not save for his retirement till date but now decides to save Rs. 50000 per month till his retirement age of 65. He anticipates that the return in the first 5 years would be 13% p.a. next 5 years 10% and in the last 5 years 8% p.a. He wants to accumulate a corpus of Rs. 1.50 Crores till his retirement. Calculate the surplus or shortfall he would have on his retirement.

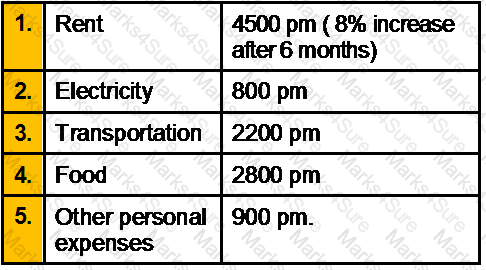

Alok a 28 years old person has joined SABH on 1/07/2006. His monthly salary (net salary) after deduction is payable Rs. 22500/. His monthly expenses details are as follows:

Assume Alok takes a flat on rent from 01 /07/2006. On 01 /07/2006 he has cash in hand Rs. 1450/-. He starts paying insurance premium from October @ Rs. 2500/- pm. His investments in Mutual fund SIP are Rs. 3000/- pm for a 6 month period. What will be his cash in hand on 31/03/2007.?

Vinod is projecting an income stream providing Rs. 2,000/- for first 3 months, Rs. 3,200 for next 2 months, Rs. 4,500 for next 1 month, Rs. 3,700 for next 6months and Rs. 800 for 2 months thereafter. Please calculate the Present Value of this cash stream if rate of interest is 9%

A zero coupon bond of Rs 10,000 has a term to maturity of seven years and a market yield of 9 percent at the time of issue. What is the issue price? What is the duration of the bond? What is the modified duration of the bond?

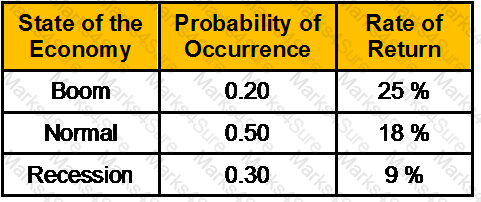

The probability distribution of the rate of return on a stock is given below:

What is the standard deviation of return?

What is the present value of the following cash flows,if the Interest rate is 8%

Ram deposits Rs. 12,500 in an account that pays a ROI of 20% pea compounded annually on 5th. Of March 2010. Calculate the date on which the balance in his account would be Rs.35,338/-.

What is the portfolios standard deviation if you put 25% of your money into stock A which has a standard deviation of 15% and rest into stocks B which has a standard deviation of 10%. The correlation coefficient between the returns of the stocks is .75.?

Mr. Raja Ram is working as a regional head in a Pharmaceutical Company. He has a annual income of Rs. 10,00,000. He will be retiring in next ten years. His current expenses are Rs. 5,00,000. The inflation rate for the foreseeable future is expected to be 5%. He assumes that his post retirement expenses will be 70% of his last year expenses of his service and they will increase at inflation rate and paid at the beginning of each year. On his retirement He plans to leave his current rented apartment and shift into a spacious and airy bungalow located on the suburbs of the city (his long cherished dream). The current price of the bungalow is Rs. 24 lakh which is estimated to increase in line with inflation rate. A ten year government security paper fetches 10% interest rate, which will remain constant for the forthcoming period. He is in good health and expects to live for twenty years after retirement.

As a CWM® you are required to calculate the amount he needs to save at the end of ten years on an annual basis so that he can pay his post retirement expenses as well as buy his dream house.

The correlation coefficient between returns on stock of M/s X Ltd and the market returns is 0.3. The variance of returns on M/s X Ltd. is 225(%)2 and that for the market returns is 100(%)2 . The risk-free rate of return is 5% and the market return is 15%. The last paid dividend is Rs. 2 and the current purchase price is Rs. 30. The growth rate for the company is 10%. The required rate of return on the security as per the Capital Asset Pricing Model is:

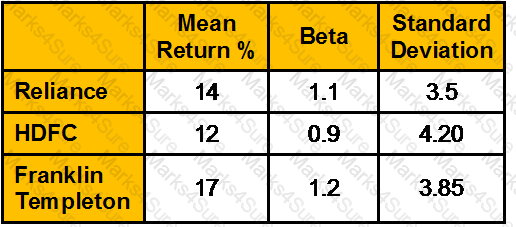

Consider the following information for three mutual funds:

Market Return 10%

Risk free return is 6%.

Calculate the Risk Adjusted Return on the basis of Jensen measure (%)?

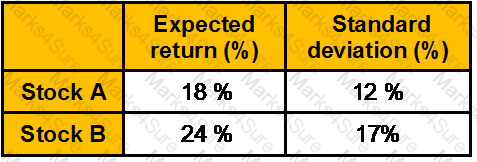

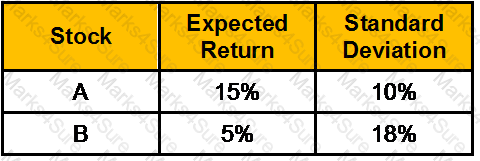

Consider two stocks, A and B

The returns on the stocks are perfectly negatively correlated.

What is the expected return of a portfolio comprising of stocks A and B when the portfolio is constructed to drive the standard deviation of portfolio return to zero?

Kapil is employed by SIDBI. He receives the following emoluments/facilities during 2006-07: Basic Salary Rs.1,40,000 DA (forming part of salary) Rs.9,000 Sale of computer to him by employer sale price Rs.20,000 (Cost of computer Rs. 2,00,000 used by employee for 3 years and 9 months) Rent free accommodation, the F.R.V. of which is Rs. 24,000 p.a. His taxable income for the assessment year 2007-08 shall be:

The expected return and standard deviations of stock A & B are:

Amit buys Rs.20,000 of Stock A and sells short Rs.10,000 of Stock B using all the Proceeds to buy more or Stock A. The correlation Between the two securities is .35. What are the expected return & standard deviation of Amit’s portfolio?

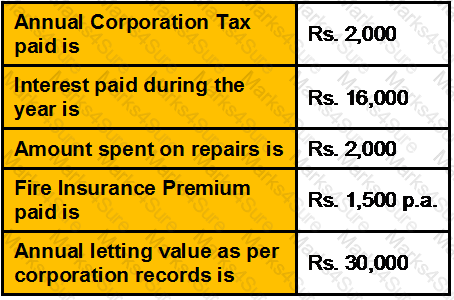

Mr. Pradip completed construction of a residential house on 1.4.2011.

Interest paid on loans borrowed for purpose of construction during the 2 years prior to completion was Rs. 40,000. The house was let-out on a monthly rent of Rs. 4,000.

Property was vacant for 3 months.

Compute the income under the head “Income from House Property” for the A.Y. 2012-13.

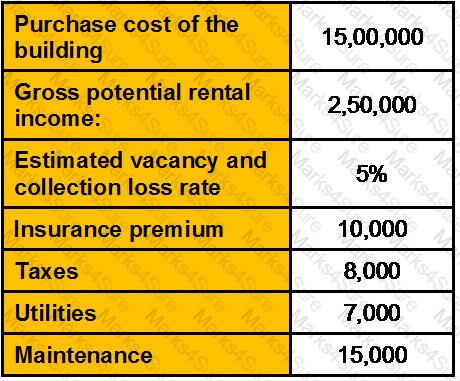

An investor is considering the purchase of a small office building and, as part of his analysis, form the following given data calculate the Net Operating Income (NOI)?

Samantha celebrated her 21st birthday today, her father gave her Rs. 6,25,000/- which is deposited in a account that pays a ROI of 12.25% p.a. compounded monthly. If she wants to withdraw Rs. 7,50,000 on her 31st. Birthday and balance on her 41stBirthday. How much can she withdraw on her 41st. birthday.?

Mr. John purchased a house in Mumbai in March 2010 for Rs.12,50,000. In April,2011 he entered into an agreement to sell the property to Mr. Akram for a consideration of Rs.19,75,000 and received earnest money of Rs. 50,000. As per the terms of the agreement, the balance payment was to be made within 30 days of the agreement. If the intending purchaser does not make the payment within 30 days, the earnest money would be forfeited. As Mr. Akram could not make the payment within the stipulated time the amount of Rs.50000 was forfeited by John. Subsequently John sold the house in June, 2011 for Rs.2130000. He paid 2% brokerage on sale of the house. Calculate the capital gains chargeable to tax for the assessment year 2012-13. [CII-12-13: 852,11-12: 785,10-11:711]

Mr. D'suza is a operations manager in a private company college in Hyderabad. During the previous year 2011-12, he gets the following emoluments:

He gets Rs. 17,500 as reimbursement from his employer in respect of medical expenditure incurred on treatment of his wife in a private clinic. Besides, he gets Rs.12, 300 as reimbursement from the employer in respect of books and journals purchased by him in discharging his official work.

He contributes 11% of his salary to statutory provident fund to which a matching contribution is made by the employer. During the year, he spends Rs.17, 000 for maintaining a car for going to the college. Determine his net income under the head salaries.

Mr. Kumar is a 40 year old NRI working abroad for past 5years. He invests Rs. 50, 000/- p.a. for past 5 years and wants to continue until his return to India. He plans to return to India after 10 years from now and enjoy his life back home. Inflation is expected to be 4% for next 30 years and his investment earns 6% interest. His expected life expectancy is 70 years. What would be his corpus at the time of return to India, and what amount he can with draw per month for his household expenses?

X furnishes the following particulars for the compilation of his wealth-tax return for assessment year 2012-13.

Rhona has a daughter Zena five years old. She wants to plan for Zena’s education and has found out that she would be requiring 2,75,000 at her age 18 and another 4,50,000 on her age 25. She also wants to have Rs. 10,00,000 for Zena’s Marriage which she expects at the age of 28. She wants to deposit the entire amount for these expenses today in an account that pays a ROI of 15% per annum compounded annually. What would this amount be?

Pankaj is an employee of a private company in Jabalpur. He draws an amount of Rs 36,000pm as basic salary. He also receives Rs 8000 as HRA. He has taken a house on rent from 1st October and pays Rs 10,000pm as rent for his house accomodation. What would be the taxable HRA?

Puspinder Singh Ahluwalia took a housing loan on 1st. of June 2009 (EMI in arrear) of Rs. 50 lacs at a ROI of 10.75% p.a. compounded monthly for 12 years. He wants to know the deduction in taxable income he can claim u/s 24 of the IT act for the FY 2011 -12

Ram purchased a house in Mumbai in March 2004 for Rs.12,50,000. In April, 2011 entered into an agreement to sell the property to Shyam for a consideration of Rs.19,75,000 and received earnest money of Rs.50,000. As per the terms of the agreement, the balance payment was to be made within 30 days of the agreement. If the intending purchaser does not make the payment within 30 days, the earnest money would be forfeited. As Shyam could not make the payment within the stipulated time the amount of Rs.50,000 was forfeited by Ram. Subsequently Ram sold the house in June,2012 for Rs. 21,30,000. He paid 2% brokerage on sale of the house. Calculate the capital gains chargeable to tax for the assessment year 2012-13. [CII-12-13: 852,11-12: 785,10-11:711,03-04:463]

The list of managing body needs for be fixed with Registrar of Joint Stock companies

Your client, a businessman has a house worth Rs. 2.1 crore and a farm house worth Rs. 85 lakh. His business is worth Rs. 10 crore as per last balance sheet. He has two other partners in the business having stakes of 24% each. He has two cars purchased at Rs. 40 lakh and Rs. 20 lakh, the latter being in personal account. The cars have depreciated/market value at Rs. 30 lakh and Rs. 8 lakh, respectively. His joint Demat account, wife being primary holder, has stocks worth Rs. 1.65 crore. The business has taken Keyman‟s insurance on his life of value Rs. 1.5 crore. He has himself insured his life for an assured sum of Rs. 1.5 crore. You evaluate your client’s estate in case of any exigency with his life as _____.

What is the surrender value, if the sum assured is Rs. 100,000/-, DOC is 01/01/1997, endowment with profit 25 years, due date of last premium paid 01/01/2010. Premium to be paid semi-annually. Accrued bonus is 500 per thousand of SA. Surrender value factor is 19% ?

Mr. Dinesh is aged 35 years and has a wife aged 30 years old and two small children. His parents are also dependent on him and has a house against which he has taken a housing loan. What is the most important insurance cover required by him at this stage?

A maximum of _____% of the trade done by a fund house can be routed through a single broker

"To be sure to receive same day credit on a Saturday, NEFT instruction has to be given by _______."

An investor investing Rs. 7,282.58 on March 1, 2012 and getting Rs. 10,000 back on February 28, 2017 would have a yield to maturity (YTM) of _____%.

You are given the following set of data on security ABC:

Calculate the expected return on security ABC?

A person is on the verge of retirement. He has sufficient funds to meet his daily regular expenses and even he has sufficient insurance coverage. He owns a house property. His family consists of him and his wife only. As a Chartered Wealth manager, which insurance policy would you suggest him?

Total income for assessment year 2007-08 of an individual including long-term capital gain of Rs. 60,000 is Rs. 1,40,000. The tax on total income shall be:

Ram born in 1950 has a life expectancy at birth of 65 years. Sita his wife born in 1955 has a life expectancy at birth of 70 years. Assuming that the life expectancies have not changed. Ram is planning to buy an annuity to be paid to him or his wife till anyone of them is alive. Assuming Ram will retire on attaining age 58 i.e. in 2008, what should be the time period of the annuity?

A 12 year annual annuity of Rs. 10000 will begin 8 years hence (the first payment occurs at the end of 8 years). What is the present value of this annuity if the discount rate is 14 percent?

Mr. Kishan owns a factory producing some small spare parts.Under which policy he can get cover against the claim for paying damages and legal costs arising from any bodily injury or damage in the premises of his property ?

An assessee was allowed deduction of unrealized rent to the extent of Rs. 40,000 in the past although the total unrealized rent was Rs. 60,000. He is able to recover from the tenant Rs.45,000 during the previous year on account of such unrealized rent. He shall be liable to tax to the extent of:

Akash has only compulsory third party policy for his car. He jumped a red light and collided with another car and then with the boundary wall of a nearby house. Damage to his car was of Rs. 17,000/-, damage to other car was of Rs. 15,000/- and damage to the boundary wall of house was of Rs. 15,000. The insurance policy of Akash will pay:

The second pillar in the Basel framework seeks to help participants to assess which of the following information?

The minimum amount for secured lenders to take the benefit of SARFAESI is _______.

Calculate current liability from the following information.

Current ratio is 1.5 and current assets are worth Rs.250

An investor buys 200 units of a Mutual Fund scheme having a reinvestment option at Rs.10.5 on Jan 6, 2011. On June 30, 2011 scheme declares a dividend @10%. The ex-dividend N.A.V. was Rs.10.25. On March12, 2012 the fund N.A.V was Rs.12.25. Calculate CAGR?

Sunil insured the building of his house for a sum of Rs.500000 against fire insurance. One day the house is totally gutted in a devastating fire. The insurance surveyors certified that the building is a total loss with no salvage value and that the insurable value of the building just prior to the loss was Rs.1000000. The insurer will pay to Sunil:

Mr.Dinesh is transferred to Delhi and is paid a shifting allowance of Rs.20000 by his employers out of which he spends Rs.18000 for shifting his family and personal effects. Which of the following is true?

Investment made in a stock 2 years ago is Rs. 175; the current value is Rs. 250. The dividend received at the end of 2nd year is Rs. 40. What is the CAGR?

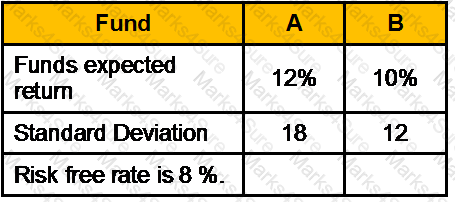

The following parameters are available for two mutual funds:

Calculate Sharpe measure?

Within how many days prospectus or statement in lieu of prospectus should file with ROC

When Government spends more than what it earns, the difference is called...............

In addition to the contribution employer has to pay ______________% of wages as administration charges.

Difference between coparceners & member is that coparcener can demand partition of an HUF

The presence of _____ in financial markets leads to adverse selection and moral hazard problems that interfere with the efficient functioning of financial markets.

The client behavior is influenced by which of following motivators in order to regulate his needs and wants?

If any expenditure is incurred by an Indian company wholly and exclusively for the purpose of amalgamation or demerger, the said expenditure is

Often burdened with loan and generally both of the spouses work to earn their living. Under which category this type of family falls?

The principle of _____________ ensures that an insured does not profit by insuring with multiple insurers

The operatives Guidelines for Banks on Mobile Transactions in India were issued

If an investment has a correlation coefficient of 0.80 with the market, which of the following performance measures is the best measure of risks?

A situation in which an owner of more than 50% of voting shares can elect the entire board of directors is known as

Which of the following is not true in respect of the conditions essential for taxing income under the head income from House Property?

Employees Provident Fund is applicable to firms employing over _______________ employees

In case of self occupied property, higher deduction u/s24(b) for interest on loan for construction can be claimed if borrowing was made

What would be the tax liability if tea and snacks are provided in the office after office hours?

Deduction u/s 80U in case of permanent physical disability (including blindness) allowed to:

Who would get the first preference when the property of a deceased person is to be distributed

Performance measurement by benchmarking normally refers to comparing performance of a fund to

_______________ and _______________ mandates are two kinds of service level contracts

A fraud is discovered with respect to an loan that has turned NPA. When is the earliest that it can be treated as a doubtful asset?

In ________, the values exchanged by the contracting parties may not necessarily be equal

In case of yearly, half yearly or quarterly premium payments …………… days of grace.

The holding period return on a stock was 30%. Its ending price was Rs.26 and its cash dividend was Rs.1.50. Its beginning price must have been __________.

What is the exemption criteria U/S 10(10) (ii) of the IT Act, 1961 for any gratuity received by a seasonal employee?

Mr. Subhash Bansal, a marketing manager is employed with IMFB limited. He took an advance of Rs. 1,20,000 against the salary of Rs. 30,000 per month in the month of March 2007. The gross salary of Mr. Adhikari for the assessment year 2007-08 shall be:

A Family consists of karta, his wife four sons and their wires and children and its income is Rs. 1000000 if by family arrangement income yield property is settled on karta his wife and sons & daughter in law than tax liability would be

Ranbir deposits Rs. 80000 as a lump sum amount in a immediate annuity. He will receive annuity on a monthly basis for next one year. Determine the monthly amount he is entitled to receive. The rate of interest is 15%

Case: The returns of 2 shares are as follows

Calculate the covariance of returns.

Broadly, world over the minimum investable assets for MULTI FAMILY OFFICE SEGMENT is :

Ms. Shweta wants to achieve the goal of higher education of her daughter after 15 years. She estimates that the funds required would be 30 lacs at then costs. She wants to invest monthly for this goal. You as a Wealth Manager suggest an asset allocation of 80% in Equity and 20% in Debt for 14 years and shifting the entire amount to liquid funds in the last year where the expected returns would be 6% p.a. If the returns in equity and debt funds are 14% and 8.50% respectively calculate the amount that needs to be invested in Equity and Debt Each Month.

You bought a stock for Rs. 20 and sold it for Rs. 59.72 after six years. What was the annual rate of return?

Movement through phases of the business cycle is initiated by shifts in aggregate demand which create fluctuations in GDP. Which combination of the following statement would be the most significant contributor to the upward shift in aggregate demand?

An employee joined in the year 2000 in a sugar mill. After working all the years as a seasonal employee up to the year 2011. He retires with the following monthly salary Basic Salary 2000 / DA 1000/ HRA 500. How much gratuity is payable to him?

Mr Ram aged 53 years has put in 21 years of service in a PSU opts for a voluntary retirement under the company scheme. He has 5 years and 3 months of service left and his last drawn salary is Rs 18,000. He received Rs 10,00,000 as compensation. What would be the taxable part of this receipt?

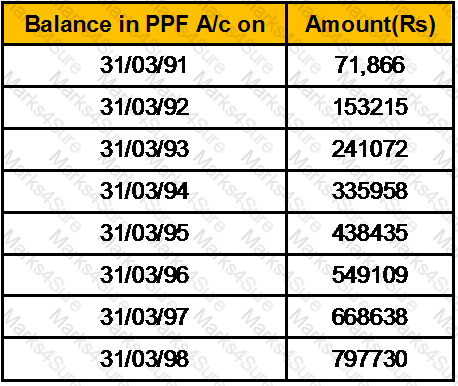

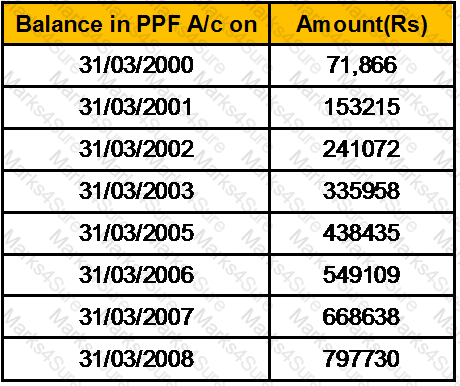

Vinod opened the PPF account on 19/11/2000, Calculate the amount he can avail as the first loan facility from the details below?

Dinesh has opened his PPF account on 19/11/1999, Calculate the amount he can avail as the first withdrawal facility from the details below?

Calculate the Net worth of Mr. Surinder Nath with the following financial details as:

A borrower defaults on a secured loan of Rs. 50,000. The underlying security is worth Rs. 60,000. Which of the following is true? "

If a Rs. 100 par value preferred stock pays an annual dividend of Rs. 5 and comparable yields are 10 percent, the price of this preferred stock will be

Mukul purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-. Please calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

The shares of Alpha were bought on Jan 1 for Rs 110/-. During the year Alpha paid a dividend of Rs 2/- per share. At the end of the year, share of Alpha was sold for Rs 115/- What is the total return on Alpha?

(CII for 1992-1993=223 and CII for 2011-2012 =785)

Calculate the LTCG in both cases?

In case of a defined benefit plan where the benefit payable is based on the terminal salary, an increase in of 10% of the wages of the employees would increase the contribution to be made by the employer for the benefit by