Which of the following qualifies as personal information under the Personal Information Protection and Electronic Documents Act (PIPEDA)?

Xerxes, 45 years old, is a successful architect, having an annual income of $185,000. He has around $10,000 in his non-registered account, which he is looking to invest in a tax-efficient manner.

From the following options, which would be the most tax-efficient?

Which statement about a net capital loss incurred by a mutual fund trust is CORRECT?

In a mutual fund dealer, who is the person responsible for establishing and maintaining compliance policies and procedures as well as monitoring and assessing compliance?

Which of the following statements about registered education savings plans (RESPs) is CORRECT?

A married couple is opening a spousal RRSP account in the name of the wife. The dealing representative gathers the information required on the NAAF, including the wife’s name, social insurance number, permanent address, and investment objectives. The representative also gathers KYC information for both and informs them that leveraging is not permitted with respect to RRSP accounts. Which information was not required?

Portia is a Dealing Representative with Highview Wealth Inc., a mutual fund dealer. Portia recommends the Stature Growth Fund to her client Clive. Which of the following CORRECTLY describes what Portia must do in order to satisfy her obligations under the Client Relationship Model (CRM) and Client Focused Reforms (CFR)?

Hamid, the portfolio manager of the Trabant Canadian Equity Fund is deciding on some new investments. He has identified a retirement residence company as well as a discount clothing retailer that both seem to have good prospects and appear undervalued. What investment approach is Hamid using?

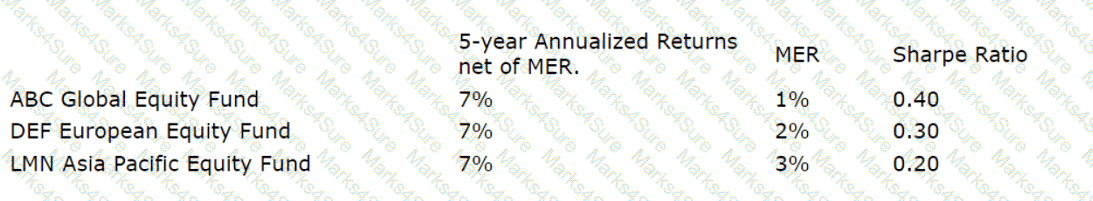

Danny is a Dealing Representative for Everbright Investments. He met with his client Adele, who has $1,000,000 to invest. During their meeting Danny determines that Adele has a high-risk profile. In addition, he learns that she has an excellent understanding of equities and how volatile they can be. Danny is considering recommending growth funds specifically, and making a recommendation from the following investment options:

Based on the information provided, which mutual fund should Danny recommend?

Which statement best describes one of the main differences between short and long transactions?

Fabiola is an optometrist and an incorporated professional. She has fallen behind schedule regarding saving for retirement. She is considering opening an Individual Pension Plan (IPP).

What provision might encourage her to use an IPP?

Natasha currently owns 2 mutual funds: a bond fund and a Canadian equity fund. She would like to use one of them as her registered retirement savings plan (RRSP) contribution for the year. From a tax efficiency perspective, which mutual fund should she contribute?

A mutual fund representative misrepresents the risks associated with a particular mutual fund in order to encourage a conservative client to purchase it. What part of MFDA Rule No. 2 “Business Conduct” did the representative violate?

Salvatore and Harriet recently got married. They are presently renting but are looking forward to buying a new home within 5 years. They both have separate savings established in their respective registered retirement savings plans (RRSPs) of $100,000 each. They have come to Dustin, a Dealing Representative, to open an additional joint investment account to increase their savings to assist with their future plans of buying a new home.

What does Dustin need to ensure about his recommendation?

Lucas wants to participate in the Lifelong Learning Program (LLP). He currently has $10,000 in his registered retirement savings plan (RRSP) for this purpose. He plans to make his maximum permitted

withdrawal of $10,000 under the LLP in two months. Based on this information, what would be his investment objective for the $10,000 currently sitting in his RRSP?

Karen’s know your client (KYC) profile corresponds to someone who has a long time horizon, is comfortable with risk and volatility, and is primarily interested in growth. She watches the daily movements of the Toronto Stock Exchange (TSX) and wants a mutual fund that will closely match what she sees.

What kind of mutual fund would be BEST for her?

Which financial leverage ratio measures a company’s ability to repay its borrowings?

Reginald is a Dealing Representative, who feels pressure from management at the beginning of every calendar year, to open new registered retirement savings plans (RRSPs) and generate RRSP contributions. It is the end of February, and Reginald is close to reaching his personal sales objectives. He just finished an appointment with a prospective new client, Orel. Orel wants to open a tax-free savings account (TFSA) to build emergency savings. However, Reginald recommended to Orel that he should first contribute to an RRSP, and then use the tax savings for a TFSA contribution. With regards to account suitability, what can be said about Reginald's advice?

Kendrick is a newly registered Dealing Representative for Oak Solid Financial. He has been assigned the task of contacting existing clients where there has been no record of consultation within the last 12 months. The first person he sees on his list is a client named Chandra Ruffino. He double-checks if her phone number is on the Do Not Call List (DNCL) registry.Which of the following statements apply?

Which Sharpe ratio result would indicate that the fund earned a return less than the risk-free return?

On January 2nd of this year Evan purchased 500 preferred shares of Ingram Ltd. The preferred shares have a par value of $25 per share and a quarterly dividend of $0.98 per share. They also give Evan the option to sell the shares back to Ingram at par value any time from now until September 1st two years from now. What type of preferred shares does Evan own?

Karen works Monday to Wednesday for a member of the MFDA as a dealing representative and Thursday and Friday as a language instructor at a local college. Client orders received on Thursdays and Fridays are held until Karen returns to work the following week. What condition of dual employment is violated under these circumstances?

During the calendar year, Firmansyah received a $1,800 eligible dividend from a large Canadian bank and a $US dollar (USD) dividend of $882.02 from a foreign-based corporation. The USD/CAD exchange rates is 1.3605.

Firmansyah's federal marginal tax bracket is 29%. The enhanced dividend gross-up rate is 38% and the federal dividend tax credit rate for eligible dividends is 15%.

What federal tax liability will be result from his investment income?

What bias would influence an investor’s decision to continue to hold an unprofitable investment despite little likelihood of an improvement in the investment’s value?

You are collecting know your client (KYC) information for your new client, Yael. She has recently accepted an early retirement package from her employer and has $100,000 to invest. She is looking for an investment that will provide income to help pay her ongoing monthly expenses. Without this extra income, she would have trouble paying her bills. From your discussions, Yael understands that markets fluctuate and says she is comfortable with high risk. Which of the following would be a suitable investment?

Faruq is a Dealing Representative with Smart Planning Group, a mutual fund dealer. Faruq meets with his new client, Taline, and learns that she lives on a low, fixed income.

Taline tells Faruq that she wants to maximize her investment returns as high as possible to make up the difference. Taline also indicates that she cannot afford large investment losses because her income is low. Which of the following CORRECTLY describes how Faruq should assess Taline’s risk profile?

How is a $10,000 withdrawal from a registered retirement savings plan (RRSP) taxed?

Exchange traded funds (ETFs) that track an index and index mutual funds have many similarities. However, what is a major difference between these two products?

Loretta is looking for a well diversified equity fund. Her ideal mutual fund would hold investments within and outside Canada. Although she is seeking growth, Loretta also wants a mutual fund that invests in quality companies.

Which of the following mutual funds would be the best choice for Loretta?

Your clients, Philip and Helen, have a disabled son, Alex, age 22. They want to set up a registered disability savings plan (RDSP) for Alex and have asked you for some information.

Which statement is TRUE?

Ellen and her only son Jeff live on the family farm with her father George. Jeff is five years old and Ellen has decided that it is time to start saving for Jeff’s post-secondary education. She has called you to ask about registered education savings plans (RESPs).

Which of the following statements is TRUE?

For the last year, an investor earned a return before adjustment for inflation of 2% on a money market fund, while inflation averaged 1.5%. What was his nominal rate of return?

What bias results in investors valuing an asset that they own over an asset that another individual owns?

On which of the following does the Personal Information Protection and Electronic Documents Act (PIPEDA) impose requirements?

Gregory is a conservative investor who wants to hold a portfolio of equity securities that would fall less than the overall market in a downturn.

Which of the following portfolios would you advise Gregory to invest in?

If the Consumer Price Index (CPI) was 140.6 last year and 146.9 this year, what was the inflation rate over the year?

Charlotte has received proceeds from a deceased family member’s estate. Charlotte decides to visit Malik, who’s a Dealing Representative at her bank. She tells Malik, she does not know much about trading ETFs, but she wants to invest in ETFs. Charlotte says she feels fortunate to have this money and that she’s not worried about losing it because she never planned on having any of it.

What element of the Know Your Client (KYC) information has Malik been able to learn?

Your client Charlie is thinking about making a large investment into the Sentinel Canadian Equity Fund on December 15. The ex-dividend date for the mutual fund is December 20. What advice would you give

Charlie to avoid the tax trap?

Which factors would cause the management expense ratio charged by a mutual fund to be higher?

The fund invests in foreign equities

The fund is large in size

The fund is managed by the fund sponsor’s management team

The fund pays a trailer fee

One of your clients, Harry, has heard that he can defer paying tax on capital gains. He wants to know if what he has heard is correct and if so, how to defer paying taxes on capital gains.

What would you tell Harry?

Based on the financial planning pyramid, what security would be appropriate for a very aggressive investor?

Sujay contributes 3% of his $60,000 salary to his employer’s defined contribution pension plan. His employer contributes the same amount to the plan. How will this affect his registered retirement savings plan (RRSP) contribution room for the year?

Based on your discussions with your client Sierra, you believe an asset allocation of 30% fixed income and 70% equities will help her achieve her long-term goals.What type of asset allocation strategy are you implementing?

Catarina is a Dealing Representative for Ethical Financial which represents 20 different mutual fund families. Darlene is a fund manager from one of those mutual fund families and wants to send a gift card to Catarina as a symbol of appreciation. Ethical Financial's policies and procedures manual (PPM) require that Catarina decline the gift.

What method of addressing conflict of interest is being used by Ethical Financial?

What stage in the business cycle typically has increasing wages, rising inflation, rising interest rates with slowing sales, and decreasing business investment?

When comparing the current yield and yield-to-maturity of a bond, which statement applies?

Your client has very limited investment knowledge and is confused about what is meant by "marginal tax rate". What do you tell him?

What term describes the range of possible future outcomes on the price of a security?

The ZZZ Money Market Fund has a 7-day yield of 0.05%. What is the current yield for the fund? Round your answer to two decimal places.

Which of the following statements is true when comparing fund of funds to traditional mutual funds?

You are the portfolio manager for the ABC asset allocation fund. Interest rates are going up; the stock market has been very volatile recently and is forecast to continue that way for the next two quarters. What changes, if any, will you make to your current asset allocation of 50% bonds and 50% equities?

Recently interest rates have gone up. Your customer, Mr. Corelli, has asked you how this will affect the value of his mortgage fund. What is the best response to give to Mr. Corelli?

Which of the following money market securities have the highest degree of risk for the investor?

Ayan wants to make a registered retirement savings plan (RRSP) contribution and deduct it from his Year 1 income. What is the deadline for this contribution (assume that it is NOT a leap year)?

Malik has been saving money for retirement but he is worried about the impact inflation may have on the value of his savings. He wants to purchase a bond that will give him a steady stream of income that is greater than the inflation rate. He has found a bond issued by a major airline with a market price of $9,200, a par value of $10,000, and a coupon rate of 6.75%.What is the current yield of this bond?

What type of fund offers the highest expected risk and the highest expected return in terms of the risk-return trade-off between different types of mutual funds?

Leira has a marginal tax rate of 45% and may deduct $5,000 in registered retirement savings plan (RRSP) contributions on her income tax return. If she decides to use her available deduction and assuming

this does not reduce her taxable income to a lower tax bracket, by how much will it reduce her tax payable?

Which exemplifies the tendency of mutual fund companies to shut down poor performing funds?

Pippa purchased a 15-year bond with a face value of $5,000 and a 7% coupon rate at the time of issuance. The bond is due to mature later this year. The general interest rate climate remained stable for the first 13 years of the bond's term. However, especially over the past 18 months, both inflation and general interest rates have increased more than expected.

What is Pippa likely to experience from her bond?

Jonathan is a Dealing Representative who has just finished an appointment with his new client, Shirley. Jonathan has concluded that Shirley has a low-risk profile but wants to establish additional savings of $500,000. During their discussion, Shirley emphasizes she wants investments that are also tax efficient. Jonathan learned that currently Shirley has no registered retirement savings plan (RRSP) and tax-free savings account (TFSA) contribution room due to using those opportunities by investmenting elsewhere.

What variable is a PRIMARY consideration for Jonathan when making an investment recommendation?

You are concerned about upcoming weakness in the Canadian dollar. Which type of fund should you invest in?

Derek submits an order to sell 300 units of the Evergreen Canadian Mortgage Fund at 8:00 p.m. EST on Friday, January 6. His proceeds will be based on the net asset value per unit (NAVPU) for which day (assume no holidays)?

Which of the following Dealing Representatives has fulfilled their "Know Your Product" obligation?

What is the characteristic of a Stage 2 – Family Commitment investor that most affects the ability to save for the long term?

Your client earns $100,000 from employment and $10,000 from investments each year. Her bills total $95,000 annually. What is her discretionary income?

What best describes why mortgage funds generally have less sensitivity to changes in interest rates than bond funds?

Sean purchases 500 units of Penn Canadian Equity Fund when the net asset value per unit (NAVPU) is $16.70. On December 15, the mutual fund’s NAVPU is $21. On December 16, the mutual fund declares a distribution of $1.25 per unit. Sean’s distribution is immediately reinvested and he purchases additional units of the mutual fund.

Which of the following statements about the effect of the distribution is correct?

Maxine is a portfolio manager who 15 years ago, purchased 100 shares of Never2Tacky, a social media corporation for Aspirations Global Technology Fund. She purchased the stock when it was trading at $10. Last year, the peak market price was $120. Presently, it is trading at $99. News agencies are now reporting that additional regulations regarding social media companies are about to be agreed upon by G7 countries. Maxine is concerned the market value of Never2Tacky is going to drop. She buys a put option with an exercise price of $95 with an expiry of 9 months.

What type of strategy is Maxine using?

The Optima Equity Fund has a beta of 1.4. What is the most accurate way to describe the Optima Equity Fund’s relationship to the market as a whole?

Quinton, a Dealing Representative, meets with his client Banji. Banji’s Know Your Client (KYC) indicates that her risk profile is “medium’’. Banji currently has $35,000 in her account which is invested 50% in the Middleton Balanced Fund and 50% in the Hector Growth Fund. She tells Quinton that she would like to contribute an additional $10,000 to purchase the Prospect Labour-Sponsored Fund. Which of the following statements about Banji’s proposed transaction is CORRECT?

Josephine is a Dealing Representative with Sunshine Mutual Funds Inc. for over 10 years. Her brother Jonathan has an account with Sunshine Mutual Funds Inc., too. Jonathan wants Josephine to manage his

portfolio and make investment decisions on his behalf. Jonathan trusts his sister to make better investment choices than he can. He also wants to give Power of Attorney (POA) to Josephine so she can have full authority over his account.

How can Josephine respond to her brother's request?

Which of the following statements about total return for money market funds is TRUE?

Pacari is a Dealing Representative with Cavalry Investments, a mutual fund dealer. Pacari’s client, Darsha, is a long-time customer and an elderly widow. Darsha depended on her husband, for financial decisions before he passed. Pacari has also noticed that Darsha’s capacity seems to be declining over the years. Luckily, with Pacari’s help, Darsha has been managing her finances well. However, Darsha’s daughter has been getting involved recently and has even tried to enter trades without Darsha’s authorization. Pacari is particularly concerned about the last transaction for Darsha’s account: a very large redemption. Pacari fears that Darsha has become a victim of financial exploitation and he raises his concerns with his dealer Cavalry. Which of the following statements about how Cavalry may proceed is CORRECT?

Which statement best describes what a rational investor will do when comparing the risk and return of two investments?

What type of managed fund, recently introduced to Canada, is allowed greater use of short sales, leverage, and derivatives compared to mutual funds, but not to the same extent as hedge funds?

Sandra presently participates in her employer-sponsored defined contribution pension plan (DCPP). As contributions continue to be made into her plan, what can she expect?

Which newspaper article would be likely to result in foreign capital moving out of a country?

Khuyen is a Dealing Representative for Stark Contrast Investments. Her dealer has relationships with 20 different mutual fund families. This gave her the flexibility to sell two different types of funds from two

different fund families to her client, Bao. $5,000 was invested in the Blue Moon Global Balanced fund and an additional $5,000 was invested in the Orange Sun Asset Allocation fund. Khuyen has been

reviewing the performance of both funds and has determined that Bao would be better off being fully invested in the Blue Moon Global Balance fund. Bao had previously signed a Limited Authorization Form

(LAF) for Khuyen, so she goes ahead and does not worry about consulting with Bao before making the change.

What type of activity has Khuyen performed?

Your client Jerry's asset mix is deviating from the original target asset mix because the stock market has had strong performance. Equities are now over-weighted in Jerry's account. The original target asset mix is still valid since Jerry's situation has not changed. He is invested in several bond and equity mutual funds.What should you do?

Pierre buys a call option on a stock. What is the implication of this transaction?

Terri, 30 years old, is the marketing manager at Provincial Winery with an average annual income of $60,000. Her spouse Yvette, 28 years old, is a project manager with a telecommunications firm earning

$70,000 per year. You are helping them to organize their investments and are trying to assess their financial resources.

Which of the following is the best question to ask?

Iliana owns 1,000 participating preferred shares in the First Canadian Bank. Which of the following features are characteristic of her investment?

Xerxes, 45 years old, is a successful architect, having an annual income of $185,000. He has around $10,000 in his non-registered account, which he is looking to invest in a tax-efficient manner.

From the following options, which would be the most tax-efficient?

Which of the following is included when calculating a country's gross domestic product (GDP)?

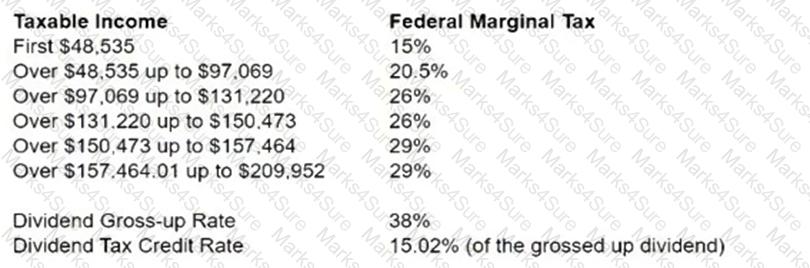

Last year Peter’s earned income from employment was $50,000.

Last year, after receiving a $2 per share in dividends from 500 shares in ABC Inc., a publicly-traded Canadian corporation, he sold his shares. The sale resulted in a capital gain of $15,000.

Based on the tax rates mentioned above, what is Peter’s net federal tax liability for the year? (Round to 2 decimal places).

A mutual fund sales representative is asked to make a presentation to an investment club. During the presentation, he discusses personal experiences of a questionable nature. What aspect of Professionalism is relevant to this situation?