John is looking at the potential of three different projects and is considering the Return on Investment. What is meant by this, and what are the benefits and disadvantages of using this method? Which option should he choose? (25 marks)

See the answer in Explanation below:

Part 1: What is meant by Return on Investment (ROI)? (8 marks)

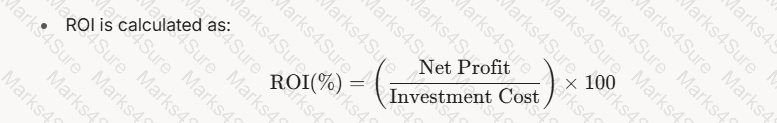

Return on Investment (ROI) is a financial metric used to evaluate the efficiency or profitability of an investment by measuring the return generated relative to its cost. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, ROI is a key tool for assessingthe financial viability of projects or contracts, ensuring they deliver value for money. Below is a step-by-step explanation:

Definition:

A math equation with numbers and a square

AI-generated content may be incorrect.

A math equation with numbers and a square

AI-generated content may be incorrect.

Net Profit = Total Returns – Investment Cost.

Purpose:

It helps decision-makers like John compare the financial benefits of projects against their costs.

Example: A project costing £100k that generates £120k in returns has an ROI of 20%.

Part 2: Benefits and Disadvantages of Using ROI (10 marks)

Benefits:

Simplicity and Clarity:

ROI is easy to calculate and understand, providing a straightforward percentage to compare options.

Example: John can quickly see which project yields the highest return.

Focus on Financial Efficiency:

It aligns with L5M4’s emphasis on value for money by highlighting projects that maximize returns.

Example: A higher ROI indicates better use of financial resources.

Comparability:

Allows comparison across different projects or investments, regardless of scale.

Example: John can compare projects with different investment amounts.

Disadvantages:

Ignores Time Value of Money:

ROI does not account for when returns are received, which can skew long-term project evaluations.

Example: A project with returns in Year 3 may be less valuable than one with returns in Year 1.

Excludes Non-Financial Factors:

It overlooks qualitative benefits like quality improvements or strategic alignment.

Example: A project with a lower ROI might offer sustainability benefits.

Potential for Misleading Results:

ROI can be manipulated by adjusting cost or profit definitions, leading to inaccurate comparisons.

Example: Excluding hidden costs (e.g., maintenance) inflates ROI.

Part 3: Which Option Should John Choose? (7 marks)

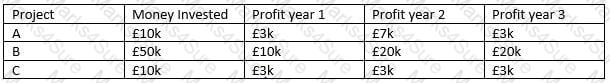

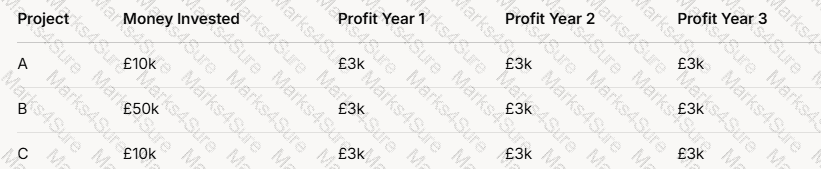

Using the data provided for the three projects, let’s calculate the ROI for each to determine the best option for John. The table is as follows:

A screenshot of a phone

AI-generated content may be incorrect.

A screenshot of a phone

AI-generated content may be incorrect.

Step 1: Calculate Total Profit for Each Project:

Project A: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project B: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project C: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Step 2: Calculate Net Profit (Total Profit – Investment):

Project A: £9k – £10k = -£1k (a loss)

Project B: £9k – £50k = -£41k (a loss)

Project C: £9k – £10k = -£1k (a loss)

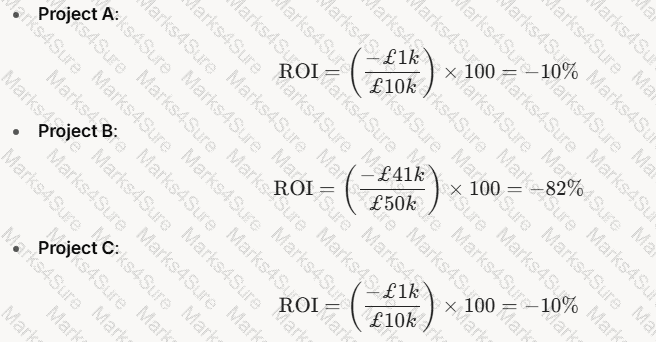

Step 3: Calculate ROI for Each Project:

A group of math equations

AI-generated content may be incorrect.

A group of math equations

AI-generated content may be incorrect.

Step 4: Compare and Choose:

Project A: -10% ROI

Project B: -82% ROI

Project C: -10% ROIAll projects show a negative ROI, meaning none generate a profit over the investment cost. However, Projects A and C have the least negative ROI at -10%, while Project B is significantly worse at -82%. Between A and C, the ROI is identical, but both require the same investment (£10k) and yield the same returns. Therefore, there is no financial difference between A and C based on ROI alone. However, since the question asks for a choice, John should choose eitherProject A or Project Cover Project B, as they minimize losses. Without additional qualitative factors (e.g., strategic fit, risk), either A or C is equally viable. For simplicity, let’s recommendProject A.

Recommendation: John should chooseProject A(or C), as it has a less negative ROI (-10%) compared to Project B (-82%), indicating a smaller financial loss.

Exact Extract Explanation:

Part 1: What is Return on Investment?

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly covers ROI in the context of financial management tools for evaluating contract or project performance. It defines ROI as "a measure of the gain or loss generated on an investment relative to the amount invested," typically expressed as a percentage. The guide positions ROI as a fundamental metric for assessing "value for money," a core principle of L5M4, especially when selecting projects or suppliers.

Detailed Explanation:

The guide explains that ROI is widely used because it provides a "clear financial snapshot" of investment performance. In John’s case, ROI helps compare the profitability of three projects.

It also notes that ROI is often used in contract management to evaluate supplier performance or project outcomes, ensuring resources are allocated efficiently.

Part 2: Benefits and Disadvantages

The study guide discusses ROI’s role in financial decision-making, highlighting its strengths and limitations, particularly in contract and project evaluations.

Benefits:

Simplicity and Clarity:

Chapter 4 notes that ROI’s "ease of calculation" makes it accessible for quick assessments, ideal for John’s scenario.

Focus on Financial Efficiency:

The guide emphasizes ROI’s alignment with "maximizing returns," ensuring investments like John’s projects deliver financial value.

Comparability:

ROI’s percentage format allows "cross-project comparisons," per the guide, enabling John to evaluate projects with different investment levels.

Disadvantages:

Ignores Time Value of Money:

The guide warns that ROI "does not consider the timing of cash flows," a critical limitation. For John, returns in Year 3 are less valuable than in Year 1 due to inflation or opportunity costs.

Excludes Non-Financial Factors:

L5M4 stresses that financial metrics alone can miss "strategic benefits" like quality or innovation, which might apply to John’s projects.

Potential for Misleading Results:

The guide cautions that ROI can be "distorted" if costs or profits are misreported, a risk John should consider if project data is incomplete.

Part 3: Which Option Should John Choose?

The guide’s focus on ROI as a decision-making tool directly supports the calculation process above. It advises using ROI to "rank investment options" but also to consider broader factors if results are close, as seen with Projects A and C.

Analysis:

The negative ROIs indicate all projects are unprofitable, a scenario the guide acknowledges can occur, suggesting further analysis (e.g., risk, strategic fit). However, based solely on ROI, A and C are better than B.

The guide’s emphasis on minimizing financial loss in poor-performing investments supports choosing A or C, as they have the least negative impact.

A local council is looking at ways it can fund a large construction project they are planning—the building of a new hospital. Discuss ways in which the council could fund the project, and the advantages and disadvantages of this (25 points)

See the answer in Explanation below:

A local council, operating in the public sector, has several options to fund a large construction project like a new hospital. Below are three funding methods, with their advantages and disadvantages explained step-by-step:

Government Grants or Funding

Step 1: Identify SourceApply for grants from central government or public health budgets allocated for infrastructure.

Step 2: ProcessSubmit detailed proposals outlining costs, benefits, and public value to secureapproval.

Advantages:

No repayment required, preserving council funds.

Aligns with public sector goals of service delivery.

Disadvantages:

Competitive process with uncertain approval.

Strict conditions may limit flexibility in project execution.

Public-Private Partnership (PPP)

Step 1: Establish PartnershipCollaborate with a private firm to finance and build the hospital, with the council leasing it back over time.

Step 2: ProcessNegotiate terms (e.g., Private Finance Initiative—PFI) where the private partner recovers costs via payments or service contracts.

Advantages:

Reduces upfront council expenditure, spreading costs over years.

Leverages private sector expertise and efficiency.

Disadvantages:

Long-term financial commitments increase future budgets.

Potential loss of control over project specifications.

Borrowing (e.g., Municipal Bonds or Loans)

Step 1: Secure FundsIssue bonds to investors or obtain loans from financial institutions, repayable over decades.

Step 2: ProcessGain approval from government regulators and allocate tax revenues for repayment.

Advantages:

Immediate access to large capital for construction.

Retains council ownership of the hospital.

Disadvantages:

Interest payments increase overall project cost.

Debt burden may strain future budgets.

Exact Extract Explanation:

The CIPS L5M4 Study Guide highlights funding options for public sector projects:

Government Grants:"Grants provide non-repayable funds but often come with stringent compliance requirements" (CIPS L5M4 Study Guide, Chapter 4, Section 4.4).

PPP:"Public-private partnerships enable infrastructure development without immediate fiscal pressure, though long-term costs can escalate" (CIPS L5M4 Study Guide, Chapter 4, Section 4.5).

Borrowing:"Borrowing via bonds or loans is common for public bodies, offering flexibility but adding debt obligations" (CIPS L5M4 Study Guide, Chapter 4, Section 4.2).These align with the public sector’s focus on value for money and service provision. References: CIPS L5M4 Study Guide, Chapter 4: Sources of Finance.===========

Outline three methods an organization could use to gain feedback from stakeholders (25 points)

See the answer in Explanation below:

Gaining feedback from stakeholders helps organizations understand their needs and improve performance. Below are three methods, detailed step-by-step:

Surveys and Questionnaires

Step 1: Design the ToolCreate structured questions (e.g., Likert scales, open-ended) tailored to stakeholder groups like customers or suppliers.

Step 2: DistributionDistribute via email, online platforms, or in-person to ensure accessibility.

Step 3: AnalysisCollect and analyze responses to identify trends or issues (e.g., supplier satisfaction with payment terms).

Outcome:Provides quantitative and qualitative insights efficiently.

Focus Groups

Step 1: Organize the SessionInvite a small, diverse group of stakeholders (e.g., employees, clients) for a facilitated discussion.

Step 2: Conduct the DiscussionUse open-ended questions to explore perceptions (e.g., “How can we improve delivery times?”).

Step 3: Record and InterpretSummarize findings to capture detailed, nuanced feedback.

Outcome:Offers in-depth understanding of stakeholder views.

One-on-One Interviews

Step 1: Select ParticipantsChoose key stakeholders (e.g., major suppliers, senior staff) for personalized engagement.

Step 2: Conduct InterviewsAsk targeted questions in a private setting to encourage candid responses.

Step 3: Synthesize FeedbackCompile insights to address specific concerns or opportunities.

Outcome:Builds trust and gathers detailed, individual perspectives.

Exact Extract Explanation:

The CIPS L5M4 Study Guide highlights stakeholder feedback methods:

Surveys:"Surveys provide a scalable way to gather structured feedback from diverse stakeholders" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).

Focus Groups:"Focus groups enable qualitative exploration of stakeholder opinions" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).

Interviews:"One-on-one interviews offer detailed, personal insights, fostering stronger relationships" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).These methods enhance stakeholder engagement in procurement and financial decisions. References: CIPS L5M4 Study Guide, Chapter 1: Organizational Objectives and Financial Management.

What is the difference between competitive and non-competitive sourcing? (12 marks)

In which circumstances may a non-competitive sourcing approach be more appropriate? (13 marks)

See the answer in Explanation below:

Part 1: What is the difference between competitive and non-competitive sourcing? (12 marks)

Competitive and non-competitive sourcing are two distinct approaches to selecting suppliers for procurement, each with different processes and implications. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, these methods impact cost, supplier relationships, and contract outcomes. Below is a step-by-step comparison:

Definition and Process:

Competitive Sourcing: Involves inviting multiple suppliers to bid for a contract through a formal process (e.g., tendering, RFQs). Suppliers compete on price, quality, and other criteria.

Example: Issuing a tender for raw materials and selecting the supplier with the best offer.

Non-Competitive Sourcing: Involves selecting a supplier without a competitive bidding process, often through direct negotiation or sole sourcing.

Example: Directly negotiating with a single supplier for a specialized component.

Key Differences:

Competition: Competitive sourcing drives competition among suppliers, while non-competitive sourcing avoids it, focusing on a single supplier.

Transparency: Competitive sourcing is more transparent, with clear criteria for selection, whereas non-competitive sourcing may lack visibility and increase the risk of bias.

Cost Focus: Competitive sourcing often secures lower prices through bidding, while non-competitive sourcing prioritizes relationship or necessity over cost.

Time and Effort: Competitive sourcing requires more time and resources (e.g., tender management), while non-competitive sourcing is quicker but may miss cost-saving opportunities.

Part 2: In which circumstances may a non-competitive sourcing approach be more appropriate? (13 marks)

Non-competitive sourcing can be more suitable in specific situations where competition is impractical or less beneficial. Below are key circumstances:

Unique or Specialized Requirements:

When a product or service is highly specialized and only one supplier can provide it, non-competitive sourcing is necessary.

Example: Sourcing a patented technology available from only one supplier.

Urgency and Time Constraints:

In emergencies or when time is critical, competitive sourcing’s lengthy process may cause delays, making non-competitive sourcing faster.

Example: Sourcing materials urgently after a supply chain disruption (e.g., a natural disaster).

Existing Strategic Relationships:

When a strong, trusted relationship with a supplier exists, non-competitive sourcing leverages this partnership for better collaboration and reliability.

Example: Continuing with a supplier who has consistently delivered high-quality materials.

Low Value or Low Risk Purchases:

For small, low-risk purchases, the cost of a competitive process may outweigh the benefits, making non-competitive sourcing more efficient.

Example: Sourcing office supplies worth £500, where tendering costs exceed potential savings.

Exact Extract Explanation:

Part 1: Difference Between Competitive and Non-Competitive Sourcing

The CIPS L5M4 Advanced Contract and Financial Management study guide addresses sourcing approaches in the context of strategic procurement, emphasizing their impact on cost and supplier relationships. It describes competitive sourcing as "a process where multiple suppliers are invited to bid," promoting transparency and cost efficiency, while non-competitive sourcing is "direct engagement with a single supplier," often used for speed or necessity.

Detailed Comparison:

The guide highlights that competitive sourcing aligns with "value for money" by leveraging market competition to secure better prices and terms. For example, a tender process might reduce costs by 10% through supplier bids.

Non-competitive sourcing, however, is noted as "less transparent" but "faster," suitable when competition isn’t feasible. It may lead to higher costs due to lack of price comparison but can foster stronger supplier relationships.

L5M4 stresses that competitive sourcing requires "formal processes" (e.g., RFQs, tenders), increasing administrative effort, while non-competitive sourcing simplifies procurement but risks bias or favoritism.

Part 2: Circumstances for Non-Competitive Sourcing

The study guide identifies scenarios where non-competitive sourcing is preferable, particularly when "speed, uniqueness, or strategic relationships" outweigh the benefits of competition.

Unique Requirements: The guide notes that "sole sourcing is common for specialized goods," as competition is not viable when only one supplier exists.

Urgency: L5M4’s risk management section highlights that "time-sensitive situations" (e.g., emergencies) justify non-competitive sourcing to avoid delays.

Strategic Relationships: The guide emphasizes that "long-term partnerships" can justify non-competitive sourcing, as trust and collaboration may deliver greater value than cost savings.

Low Value Purchases: Chapter 2 suggests that for "low-value transactions," competitive sourcing may not be cost-effective, supporting non-competitive approaches.

Practical Application: For XYZ Ltd (Question 7), non-competitive sourcing might be appropriate if they need a unique alloy only one supplier provides or if a sudden production spike requires immediate materials.

Describe what is meant by ‘Supply Chain Integration’ (8 marks). How would a buyer go about implementing this approach and what benefits could be gained from it? (17 marks).

See the answer in Explanation below:

Part 1: Describe what is meant by ‘Supply Chain Integration’ (8 marks)

Supply Chain Integration (SCI) refers to the seamless coordination and alignment of processes, information, and resources across all parties in a supply chain—suppliers, manufacturers, distributors, and buyers—to achieve a unified, efficient system. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, SCI emphasizes collaboration to optimize performance and deliver value. Below is a step-by-step explanation:

Definition:

SCI involves linking supply chain partners to work as a cohesive unit, sharing goals, data, and strategies.

It spans upstream (suppliers) and downstream (customers) activities.

Purpose:

Aims to eliminate silos, reduce inefficiencies, and enhance responsiveness to market demands.

Example: A buyer and supplier share real-time inventory data to prevent stockouts.

Part 2: How would a buyer go about implementing this approach and what benefits could be gained from it? (17 marks)

Implementation Steps:

Establish Collaborative Relationships:

Build trust and partnerships with suppliers through regular communication and joint planning.

Example: Set up quarterly strategy meetings with key suppliers.

Implement Information Sharing Systems:

Use technology (e.g., ERP systems, cloud platforms) to share real-time data on demand, inventory, and forecasts.

Example: Integrate a supplier’s system with the buyer’s to track orders live.

Align Objectives and KPIs:

Agree on shared goals and performance metrics (e.g., delivery speed, cost reduction) to ensure mutual accountability.

Example: Both parties target a 95% on-time delivery rate.

Streamline Processes:

Redesign workflows (e.g., joint procurement or production planning) to eliminate redundancies.

Example: Co-develop a just-in-time delivery schedule.

Benefits:

Improved Efficiency:

Streamlined operations reduce waste and lead times.

Example: Cutting order processing time from 5 days to 2 days.

Cost Savings:

Better coordination lowers inventory holding costs and optimizes resource use.

Example: Reducing excess stock by 20% through shared forecasting.

Enhanced Responsiveness:

Real-time data enables quick adaptation to demand changes.

Example: Adjusting supply within 24 hours of a sales spike.

Stronger Relationships:

Collaboration fosters trust and long-term supplier commitment.

Example: A supplier prioritizes the buyer during shortages.

Exact Extract Explanation:

Part 1: What is Supply Chain Integration?

The CIPS L5M4 Advanced Contract and Financial Management study guide does not dedicate a specific section to SCI but embeds it within discussions on supplier relationships and performance optimization. It describes SCI as "the alignment of supply chain activities to achieve a seamless flow of goods, services, and information." The guide positions it as a strategic approach to enhance contract outcomes by breaking down barriers between supply chain partners, aligning with its focus on value delivery and financial efficiency.

Detailed Explanation:

SCI integrates processes like procurement, production, and logistics across organizations. The guide notes that "effective supply chains require coordination beyond contractual obligations," emphasizing shared goals over transactional interactions.

For example, a manufacturer (buyer) integrating with a raw material supplier ensures materials arrive just as production ramps up, avoiding delays or overstocking. This reflects L5M4’s emphasis on operational and financial synergy.

Part 2: Implementation and Benefits

The study guide highlights SCI as a means to "maximize efficiency and value," linking it to contract management and financial performance. It provides implicit guidance on implementation and benefits through its focus on collaboration and performance metrics.

Implementation Steps:

Establish Collaborative Relationships:

Chapter 2 stresses "partnership approaches" to improve supplier performance. This starts with trust-building activities like joint workshops, aligning with SCI’s collaborative ethos.

Implement Information Sharing Systems:

The guide advocates "technology-enabled transparency" (e.g., shared IT platforms) to enhance visibility, a cornerstone of SCI. This reduces guesswork and aligns supply with demand.

Align Objectives and KPIs:

L5M4 emphasizes "mutually agreed performance measures" (e.g., KPIs like delivery accuracy). SCI requires this alignment to ensure all parties work toward common outcomes.

Streamline Processes:

The guide suggests "process optimization" through collaboration, such assynchronized planning, to eliminate inefficiencies—a practical step in SCI.

Benefits:

Improved Efficiency:

The guide links integrated processes to "reduced cycle times," a direct outcome of SCI. For instance, shared data cuts delays, aligning with operational goals.

Cost Savings:

Chapter 4 highlights "minimizing waste" as a financial management priority. SCI reduces excess inventory and transport costs, delivering tangible savings.

Enhanced Responsiveness:

The guide notes that "agile supply chains adapt to market shifts," a benefit of SCI’s real-time coordination. This supports competitiveness, a strategic L5M4 focus.

Stronger Relationships:

Collaboration "builds resilience and trust," per the guide. SCI fosters partnerships, ensuring suppliers prioritize the buyer’s needs, enhancing contract stability.

Practical Application:

For XYZ Ltd (from Question 7), SCI might involve integrating a raw material supplier into their production planning. Implementation includes an ERP link for inventory data, aligned KPIs (e.g., 98% delivery reliability), and joint scheduling. Benefits could include a 15% cost reduction, 3-day faster lead times, and a supplier committed to priority service during peak demand.

The guide advises balancing integration costs (e.g., IT investment) with long-term gains, a key financial consideration in L5M4.

How could an organisation approach conducting an Industry Analysis? Describe the areas which would be useful to analyse. (25 marks)

See the answer in Explanation below:

Conducting an industry analysis is a strategic process that helps an organization understand the external environment in which it operates, enabling better decision-making in procurement, contract management, and supplier relationships. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, industry analysis supports strategic sourcing and risk management by identifying opportunities and threats that impact financial and operational outcomes. Below is a detailed step-by-step approach to conducting an industry analysis, followed by key areas to analyze.

Approach to Conducting an Industry Analysis:

Define the Industry Scope:

Clearly identify the industry or market segment relevant to the organization’s operations (e.g., raw materials for manufacturing).

Example: For XYZ Ltd (Question 7), the focus might be the steel industry for raw materials.

Gather Data from Multiple Sources:

Use primary sources (e.g., supplier interviews, industry reports) and secondary sources (e.g., market research, government data) to collect information.

Example: Reviewing trade publications likeSteel Times Internationalfor market trends.

Apply Analytical Frameworks:

Use tools like Porter’s Five Forces (Question 12) or PESTLE analysis to structure the evaluation of competitive and external factors.

Example: Using Porter’s Five Forces to assess supplier power in the steel industry.

Analyze Trends and Patterns:

Identify historical and emerging trends (e.g., price volatility, technological advancements) to predict future market dynamics.

Example: Noting a trend toward sustainable steel production.

Engage Stakeholders:

Involve internal teams (e.g., procurement, finance) and external partners (e.g., suppliers) to validate findings and gain insights.

Example: Discussing supply chain risks with key steel suppliers.

Synthesize Findings and Develop Strategies:

Compile the analysis into actionable insights to inform sourcing strategies, contract terms, and risk mitigation plans.

Example: Deciding to diversify suppliers due to high supplier power in the industry.

Areas to Analyze:

Market Structure and Competition:

Assess the competitive landscape using Porter’s Five Forces, focusing on rivalry,supplier/buyer power, new entrants, and substitutes.

Why Useful: Helps understand competitive pressures that affect pricing and supplier negotiations.

Example: High rivalry in the steel industry might drive down prices but increase innovation demands on suppliers.

Market Trends and Growth Potential:

Examine industry growth rates, demand trends, and emerging opportunities or threats (e.g., shifts to green technology).

Why Useful: Identifies opportunities for cost savings or risks like supply shortages.

Example: Rising demand for recycled steel could increase prices, impacting XYZ Ltd’s costs.

Regulatory and Legal Environment:

Analyze regulations, trade policies, and compliance requirements affecting the industry (e.g., environmental laws, import tariffs).

Why Useful: Ensures sourcing decisions align with legal standards, avoiding fines or disruptions.

Example: Stricter carbon emission laws might require sourcing from eco-friendly steel suppliers.

Technological Developments:

Investigate innovations, automation, or digitalization trends that could impact supply chains or supplier capabilities.

Why Useful: Highlights opportunities to leverage technology for efficiency or risks of obsolescence.

Example: Adoption of AI in steel production might improve supplier efficiency but require new contract terms for quality assurance.

Economic and Financial Factors:

Evaluate economic conditions (e.g., inflation, currency fluctuations) and financial stability of the industry (e.g., profitability trends).

Why Useful: Informs cost projections and risk assessments for contract planning.

Example: Inflation-driven steel price increases might necessitate flexible pricing clauses in contracts.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes industry analysis as a critical step in "understanding the external environment" to inform procurement strategies and contract management. It is discussed in the context of market analysis and risk management, aligning with the module’s focus on achieving value for money and mitigating supply chain risks. The guide does not provide a step-by-step process but highlights tools like Porter’s Five Forces and PESTLE, which are integrated into the approach above, and identifies key areas of focus that impact financial and operational outcomes.

Approach to Conducting Industry Analysis:

The guide stresses the importance of "systematic market analysis" to support strategic sourcing (Question 11) and supplier selection (Question 7). Steps like defining the scope, gathering data, and using frameworks like Porter’s Five Forces are derived from its emphasis on structured evaluation.

Data Gathering: Chapter 2 advises using "multiple data sources" (e.g., industry reports, supplier feedback) to ensure a comprehensive view, reducing the risk of biased decisions.

Stakeholder Engagement: The guide highlights "collaboration with stakeholders" to validate market insights, ensuring procurement strategies are practical and aligned with organizational needs.

Actionable Insights: L5M4’s focus on translating analysis into "strategic decisions" supports the final step of developing sourcing or contract strategies based onfindings.

Areas to Analyze:

Market Structure and Competition:

The guide explicitly references Porter’s Five Forces (Question 12) as a tool to "assess competitive dynamics." Understanding rivalry or supplier power helps buyers negotiate better terms, ensuring cost efficiency—a core L5M4 principle.

Market Trends and Growth Potential:

Chapter 2 notes that "market trends impact supply availability and pricing." For XYZ Ltd, analyzing steel demand trends ensures they anticipate cost increases and secure supply, aligning with financial planning.

Regulatory and Legal Environment:

The guide’s risk management section emphasizes "compliance with external regulations." Industry analysis must consider laws like environmental standards, which could limit supplier options or increase costs, requiring contract adjustments.

Technological Developments:

L5M4 highlights "technology as a driver of efficiency" in supply chains. Analyzing tech trends ensures buyers select suppliers capable of meeting future needs, supporting long-term value.

Economic and Financial Factors:

The guide stresses that "economic conditions affect cost structures." Inflation or currency fluctuations can impact supplier pricing, necessitating flexible contract terms to manage financial risks.

Practical Application for XYZ Ltd:

Approach: XYZ Ltd defines the steel industry as their focus, gathers data from trade reports and supplier discussions, applies Porter’s Five Forces, analyzes trends (e.g., rising steel prices), engages their procurement team, and decides to negotiate long-term contracts to lock in prices.

Areas: They assess high supplier power (Market Structure), rising demand for sustainable steel (Trends), new carbon regulations (Regulatory), automation in steel production (Technology), and inflation pressures (Economic), ensuring their sourcing strategy mitigates risks and controls costs.

Broader Implications:

The guide advises conducting industry analysis regularly, as markets are dynamic—e.g., new regulations or technologies can shift supplier dynamics.

Financially, this analysis ensures cost control by anticipating price changes or disruptions, aligning with L5M4’s focus on value for money. It also supports risk management by identifying threats like regulatory non-compliance or supplier instability.

XYZ Ltd is a retail organization that is conducting a competitive benchmarking project. What are the advantages and disadvantages of this? (25 points)

See the answer in Explanation below:

Competitive benchmarking involves XYZ Ltd comparing its performance with a rival retailer. Below are the advantages and disadvantages, explained step-by-step:

Advantages

Identifies Competitive Gaps

Step 1: ComparisonXYZ assesses metrics like pricing, delivery speed, or customer service against a competitor.

Step 2: OutcomeHighlights areas where XYZ lags (e.g., slower delivery), driving targeted improvements.

Benefit:Enhances market positioning.

Drives Performance Improvement

Step 1: LearningAdopting best practices from competitors (e.g., efficient inventory management).

Step 2: OutcomeBoosts operational efficiency and customer satisfaction.

Benefit:Strengthens competitiveness in retail.

Market Insight

Step 1: AnalysisProvides data on industry standards and trends.

Step 2: OutcomeInforms strategic decisions (e.g., pricing adjustments).

Benefit:Keeps XYZ aligned with market expectations.

Disadvantages

Data Access Challenges

Step 1: LimitationCompetitors may not share detailed performance data.

Step 2: OutcomeRelies on estimates or public info, reducing accuracy.

Drawback:Limits depth of comparison.

Risk of Imitation Over Innovation

Step 1: FocusCopying rivals may overshadow unique strategies.

Step 2: OutcomeXYZ might lose differentiation (e.g., unique branding).

Drawback:Stifles originality.

Resource Intensive

Step 1: EffortRequires time, staff, and costs to gather and analyze data.

Step 2: OutcomeDiverts resources from other priorities.

Drawback:May strain operational capacity.

Exact Extract Explanation:

The CIPS L5M4 Study Guide discusses competitive benchmarking:

Advantages:"It identifies gaps, improves performance, and provides market insights" (CIPS L5M4 Study Guide, Chapter 2, Section 2.6).

Disadvantages:"Challenges include limited data access, potential over-reliance on imitation, and high resource demands" (CIPS L5M4 Study Guide, Chapter 2, Section 2.6).This is key for retail procurement and financial strategy. References: CIPS L5M4 StudyGuide, Chapter 2: Supply Chain Performance Management.===========

What is a ‘Balanced Scorecard’? (15 marks). What would be the benefits of using one? (10 marks)

See the answer in Explanation below:

Part 1: What is a ‘Balanced Scorecard’? (15 marks)

A Balanced Scorecard (BSC) is a strategic performance management tool that provides a framework for measuring and monitoring an organization’s performance across multiple perspectives beyond just financial metrics. Introduced by Robert Kaplan and David Norton, it integrates financial and non-financial indicators to give a holistic view of organizational success. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, the BSC is relevant for evaluating contract performance and supplier relationships by aligning them with broader business objectives. Below is a step-by-step explanation:

Definition:

The BSC is a structured approach that tracks performance across four key perspectives: Financial, Customer, Internal Processes, and Learning & Growth.

It translates strategic goals into measurable objectives and KPIs.

Four Perspectives:

Financial Perspective: Focuses on financial outcomes (e.g., cost savings, profitability).

Customer Perspective: Measures customer satisfaction and service quality (e.g., delivery reliability).

Internal Process Perspective: Evaluates operational efficiency (e.g., process cycle time).

Learning & Growth Perspective: Assesses organizational capability and innovation (e.g., staff training levels).

Application in Contracts:

In contract management, the BSC links supplier performance to strategic goals, ensuring alignment with financial and operational targets.

Example: A supplier’s on-time delivery (Customer) impacts cost efficiency (Financial) and requires process optimization (Internal Processes).

Part 2: What would be the benefits of using one? (10 marks)

The Balanced Scorecard offers several advantages, particularly in managing contracts and supplier performance. Below are the key benefits:

Holistic Performance View:

Combines financial and non-financial metrics for a comprehensive assessment.

Example: Tracks cost reductions alongside customer satisfaction improvements.

Improved Decision-Making:

Provides data-driven insights across multiple dimensions, aiding strategic choices.

Example: Identifies if poor supplier training (Learning & Growth) causes delays (Internal Processes).

Alignment with Strategy:

Ensures contract activities support broader organizational goals.

Example: Links supplier innovation to long-term competitiveness.

Enhanced Communication:

Offers a clear framework to share performance expectations with suppliers and stakeholders.

Example: A BSC report highlights areas needing improvement, fostering collaboration.

Exact Extract Explanation:

Part 1: What is a ‘Balanced Scorecard’?

The CIPS L5M4 Advanced Contract and Financial Management study guide does not explicitly define the Balanced Scorecard in a dedicated section but references it within the context of performance measurement tools in contract and supplier management. It aligns with the guide’s emphasis on "measuring performance beyond financial outcomes" to ensure value for money andstrategic success. The BSC is presented as a method to "balance short-term financial goals with long-term capability development," making it highly relevant to contract management.

Detailed Explanation:

The guide explains that traditional financial metrics alone (e.g., budget adherence) are insufficient for assessing contract success. The BSC addresses this by incorporating the four perspectives:

Financial: Ensures contracts deliver cost efficiencies or ROI, a core L5M4 focus. Example KPI: "Cost per unit reduced by 5%."

Customer: Links supplier performance to end-user satisfaction, such as "95% on-time delivery."

Internal Processes: Monitors operational effectiveness, like "reduced procurement cycle time by 10%."

Learning & Growth: Focuses on capability building, such as "supplier staff trained in new technology."

In practice, a BSC for a supplier might include KPIs like profit margin (Financial), complaint resolution time (Customer), defect rate (Internal Processes), and innovation proposals (Learning & Growth).

The guide stresses that the BSC is customizable, allowing organizations to tailor it to specific contract goals, such as sustainability or quality improvement.

Part 2: Benefits of Using a Balanced Scorecard

The study guide highlights the BSC’s value in providing "a structured approach to performance management" that supports financial and strategic objectives. Its benefits are implicitly tied to L5M4’s focus on achieving value for money and managing supplier relationships effectively.

Holistic Performance View:

The guide notes that relying solely on financial data can overlook critical issues like quality or supplier capability. The BSC’s multi-perspective approach ensures a rounded evaluation, e.g., identifying if cost savings compromise service levels.

Improved Decision-Making:

By presenting performance data across all four areas, the BSC helps managers prioritize actions. The guide suggests that "performance tools should inform corrective measures," and the BSC excels here by linking cause (e.g., poor training) to effect (e.g., delays).

Alignment with Strategy:

Chapter 2 emphasizes aligning supplier performance with organizational goals. The BSC achieves this by translating high-level objectives (e.g., "improve market share") into actionable supplier metrics (e.g., "faster product development").

Enhanced Communication:

The guide advocates clear performance reporting to stakeholders. The BSC’s visual framework (e.g., a dashboard) simplifies discussions with suppliers, ensuring mutual understanding of expectations and progress.

Practical Example:

A company using a BSC might evaluate a supplier contract with:

Financial: 10% cost reduction achieved.

Customer: 98% customer satisfaction score.

Internal Processes: 2-day order processing time.

Learning & Growth: 80% of supplier staff certified in quality standards.

This holistic view ensures the contract delivers both immediate financial benefits and sustainable value, a key L5M4 principle.

XYZ Ltd is a manufacturing organisation who is looking to appoint a new supplier of raw materials. Describe 5 selection criteria they could use to find the best supplier. (25 marks)

See the answer in Explanation below:

Selecting the right supplier is a critical decision for XYZ Ltd, a manufacturing organization, to ensure the supply of raw materials meets operational, financial, and strategic needs. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, supplier selection criteria should align with achieving value for money, operational efficiency, and long-term partnership potential. Below are five detailed selection criteria XYZ Ltd could use, explained step-by-step:

Cost Competitiveness:

Description: The supplier’s pricing structure, including unit costs, discounts, and total cost of ownership (e.g., delivery or maintenance costs).

Why Use It: Ensures financial efficiency and budget adherence, a key focus in L5M4.

Example: A supplier offering raw materials at $10 per unit with free delivery might be preferred over one at $9 per unit with high shipping costs.

Quality of Raw Materials:

Description: The consistency, reliability, and compliance of materials with specified standards (e.g., ISO certifications, defect rates).

Why Use It: High-quality materials reduce production defects and rework costs, supporting operational and financial goals.

Example: A supplier with a defect rate below 1% and certified quality processes.

Delivery Reliability:

Description: The supplier’s ability to deliver materials on time and in full, measured by past performance or promised lead times.

Why Use It: Ensures manufacturing schedules are met, avoiding costly downtime.

Example: A supplier guaranteeing 98% on-time delivery within 5 days.

Financial Stability:

Description: The supplier’s economic health, assessed through credit ratings, profitability, or debt levels.

Why Use It: Reduces the risk of supply disruptions due to supplier insolvency, aligning with L5M4’s risk management focus.

Example: A supplier with a strong balance sheet and no recent bankruptcies.

Capacity and Scalability:

Description: The supplier’s ability to meet current demand and scale production if XYZ Ltd’s needs grow.

Why Use It: Ensures long-term supply reliability and supports future growth, a strategic consideration in contract management.

Example: A supplier with spare production capacity to handle a 20% volume increase.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes supplier selection as a foundational step in contract management, directly impacting financial performance and operational success. The guide advises using "robust criteria" to evaluate suppliers, ensuringthey deliver value for money and mitigate risks. While it does not list these exact five criteria verbatim, they are derived from its principles on supplier appraisal and performance management.

Criterion 1: Cost Competitiveness:

The guide stresses "total cost of ownership" (TCO) over just purchase price, a key financial management concept in L5M4. This includes direct costs (e.g., price per unit) and indirect costs (e.g., transport, storage). For XYZ Ltd, selecting a supplier with competitive TCO ensures budget efficiency.

Application: A supplier might offer lower initial costs but higher long-term expenses (e.g., frequent delays), making TCO a critical metric.

Criterion 2: Quality of Raw Materials:

Chapter 2 highlights quality as a "non-negotiable performance measure" in supplier evaluation. Poor-quality materials increase rework costs and affect product reliability, undermining financial goals.

Practical Example: XYZ Ltd might require suppliers to provide test samples or quality certifications, ensuring materials meet manufacturing specs.

Criterion 3: Delivery Reliability:

The guide links timely delivery to operational efficiency, noting that "supply chain disruptions can have significant cost implications." For a manufacturer like XYZ Ltd, late deliveries could halt production lines, incurring penalties or lost sales.

Measurement: Past performance data (e.g., 95% on-time delivery) or contractual commitments to lead times are recommended evaluation tools.

Criterion 4: Financial Stability:

L5M4’s risk management section advises assessing a supplier’s "financial health" to avoid dependency on unstable partners. A financially shaky supplier risks failing mid-contract, disrupting XYZ Ltd’s supply chain.

Assessment: Tools like Dun & Bradstreet reports or financial statements can verify stability, ensuring long-term reliability.

Criterion 5: Capacity and Scalability:

The guide emphasizes "future-proofing" supply chains by selecting suppliers capable of meeting evolving demands. For XYZ Ltd, a supplier’s ability to scale production supports growth without the cost of switching vendors.

Evaluation: Site visits or capacity audits can confirm a supplier’s ability to handle current and future volumes (e.g., 10,000 units monthly now, 12,000 next year).

Broader Implications:

These criteria should be weighted based on XYZ Ltd’s priorities (e.g., 30% cost, 25% quality) and combined into a supplier scorecard, a method endorsed by the guide for structured decision-making.

The guide also suggests involving cross-functional teams (e.g., procurement, production) to define criteria, ensuring alignment with manufacturing needs.

Financially, selecting the right supplier minimizes risks like stockouts or quality issues, which could inflate costs—aligning with L5M4’s focus on cost control and value delivery.

Practical Application for XYZ Ltd:

Cost: Compare supplier quotes and TCO projections.

Quality: Request material samples and compliance certificates.

Delivery: Review historical delivery records or negotiate firm timelines.

Financial Stability: Analyze supplier financials via third-party reports.

Capacity: Assess production facilities and discuss scalability plans.

This multi-faceted approach ensures XYZ Ltd appoints a supplier that balances cost, quality, and reliability, optimizing contract outcomes.

TESTED 24 Feb 2026