A declsioning architect wants to use the customer properties Gender and MonthlyAverageUsage in a Data Join component. Which decision component is required to enable access to these properties?

What does a dotted line from a "Group By" component to a "Filter" component mean?

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer on its website to the qualified customers. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning architect, you need to verify the configurations in the Channel tab of the Next-Best-Action Designer to enable the website to communicate with Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you ensure are complete in the Channel tab of the Next-Best-Action Designer? (Choose Two)

MyCo, a telecom company, developed a new data plan group to suit the needs of its customers. The following table lists the three data plan actions and the criteria that customers must satisfy to qualify for the offer:

A mortgage company defines a new suppression policy to limit promotional emails for home loan offers. The policy is complete, but it must be applied to all to home loan actions. The implementation team must associate this policy with the appropriate business structure.

Where should the team associate the contact policy to apply it to home loan promotions?

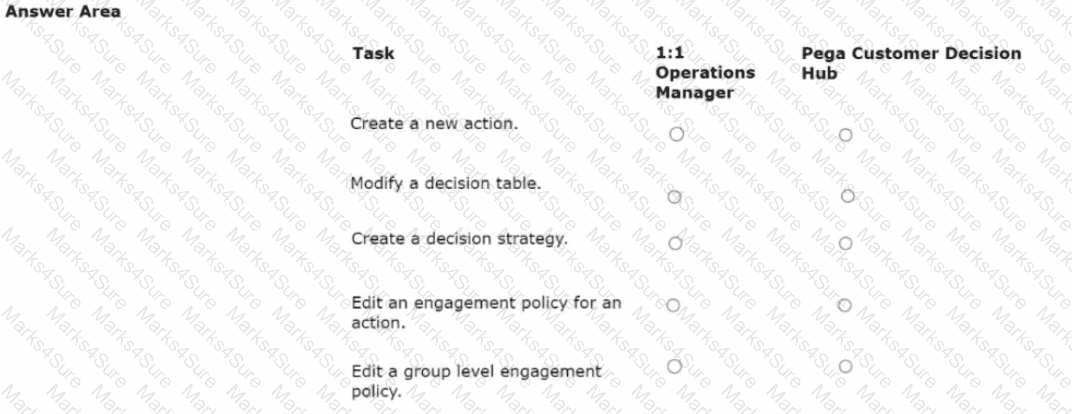

U+ Bank, a retail bank, uses the Business Operations Environment to perform its business changes. The bank carries out these changes in the Pega Customer Decision Hub portal by using revision management features or the 1:1 Operations Manager portal.

For each task, select the correct portal in which you initiate the change request based on best practices.

U+ Bank, a retail bank, has recently implemented Pega Customer Decision Hub. The bank currently uses an external tool to design email content and a third-party email service provider to send emails to its customers.

As a decisioning architect, how do you recommend the bank implements this requirement?

U+ Bank, a retail bank, is currently presenting a cashback offer on its website.

Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer:

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45.

As a business user, what are the two tasks that you define to update the cashback offer? (Choose Two)

MyCo, a telecom company, wants to introduce a new group of offers called Tablets for all customers. As a decisioning architect, which two valid actions do you create? (Choose Two)

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer. What is the next step that Pega Customer Decision Hub takes?

MyCo, a telecom company, wants to Include offer-related images in the emails that they send to their qualified customers. As a decisioning architect, what best practice do you follow to include images in emails?

A financial services company has implemented always-on outbound campaigns for three credit card offers: Standard card. Rewards card, and Rewards Plus card. The marketing team observes that customers who are qualified for multiple actions receive different numbers of offers, depending on the configuration of the volume constraint mode. To optimize customer engagement, the system administrator must choose between constraint modes.

Which volume constraint mode ensures that customers receive all actions for which they qualify, provided the actions do not reach volume limits?

The development team at U+Bank wants to create multiple test personas for their new engagement strategy quickly. A team member suggests using Pega GenAI features instead of creating a manual persona to improve efficiency and speed up the testing process.

Which advantage does Pega GenAI provide when creating personas compared to manual creation?

GlobalRetail operates in a fast-changing digital marketplace where customer preferences and competitor offers change weekly. Their marketing team struggles with lengthy approval processes that prevent quick responses to market trends, often causing them to miss critical engagement opportunities.

What does agility represent in the context of customer engagement projects?

You are the decisioning architect on an Al-powered one-to-one customer engagement implementation project. You are asked to design the next-best-action prioritization expression that balances the customer needs with the business objectives.

What factor do you consider in the prioritization expression?

U+ Bank wants to offer a Gold credit card to customers who have an annual income of more than USD150000. What do you configure in the Next-Best-Action Designer to achieve this outcome7

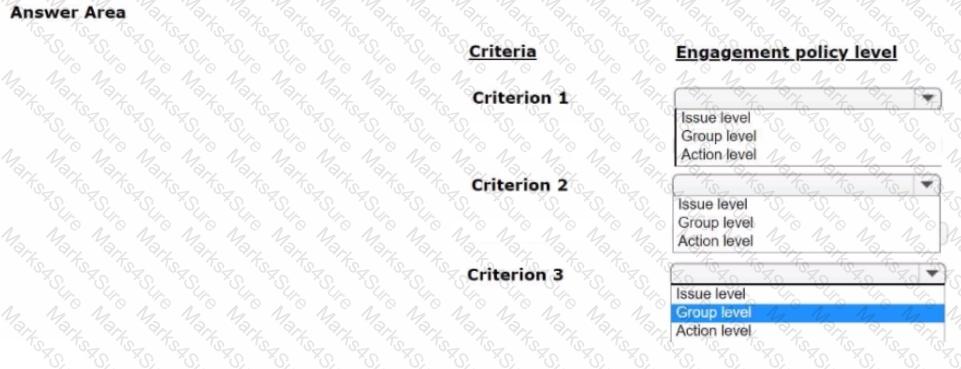

A financial services organization introduces a new policy that limits each customer to two promotional emails per month. To meet compliance requirements, the implementation team must configure this limit in the Next-Best-Action Designer.

Which configuration steps achieve the desired email frequency limit?

U+ Bank uses the always-on outbound approach to send outbound messages on different channels such as email. SMS, and push notifications. There are a variety of action flow patterns in use to meet various business and channel integrations requirements.

Due to technical reasons, the bank wants to temporarily suspend sending outbound messages and Instead write the selected customers and action details to a database table for later offline processing.

What is the most efficient way to meet this requirement?

What is the name of the property that the system computes automatically when you use an Adaptive Model decision component?

A revision manager needs to deploy changes from the business operations environment to production. The NBA Specialist has completed all build tasks and validated the generated artifacts. The team lead has promoted the change request to the revision manager for deployment processing.

Which step should you take to push the changes to production?

U+ Bank, a retail bank, introduced a new mortgage refinance offer in the eastern region of the country. They want to advertise this offer on their website by using a banner, targeting the customers who live in that area.

What do you configure in Next-Best-Action Designer to implement this requirement?

A decisioning architect wants to use the customer properties income and age in a Filter component. Which decision component is required to enable access to these properties?

U+ Bank has recently defined two contact policies:

1. Suppress a group of credit card offers for 30 days if any credit card offer is rejected three times in any channel in the past 15 days.

2. Suppress the Reward card offer, part of the credit card group, for 7 days if it is rejected twice in any channel in the last 7 days. Paul, an existing U+ Bank customer, no longer sees the Reward card offer. What is the reason that Paul cannot see the offer?

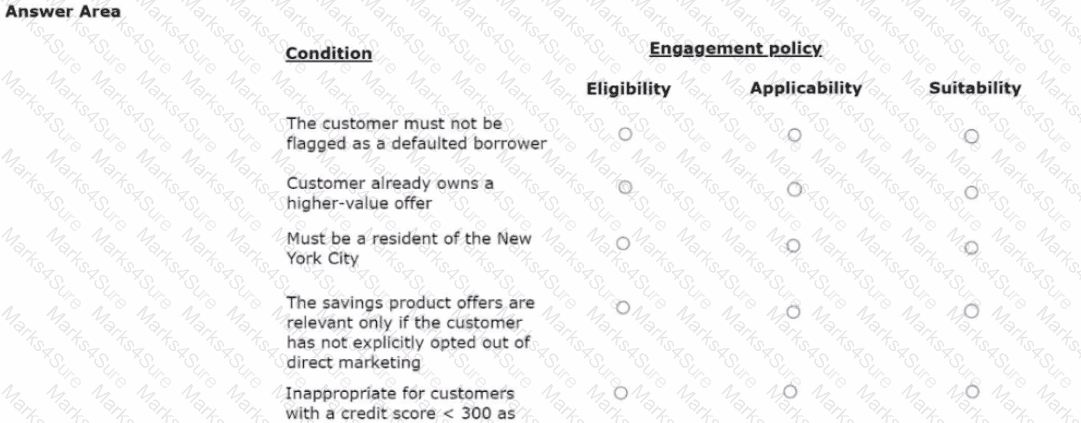

U+ Bank, a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in to the web self-service portal. The bank added engagement policy conditions to show the offers based on the bank's requirements.

In the Answer Area, select the correct engagement policy for each condition.

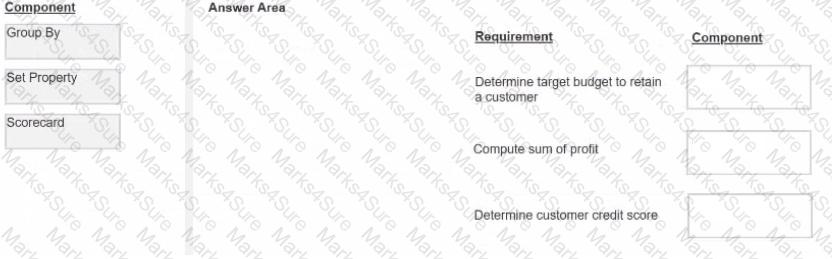

You are a decisioning architect on a next-best-action project and are responsible for designing and implementing decision strategies. Select each component on the leftand drag it to the correct requirement on the right.

U+ Bank presents various credit card offers to its customers on its website. The bank uses AI to prioritize the offers according to customer behavior. With the introduction of the Gold credit card offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

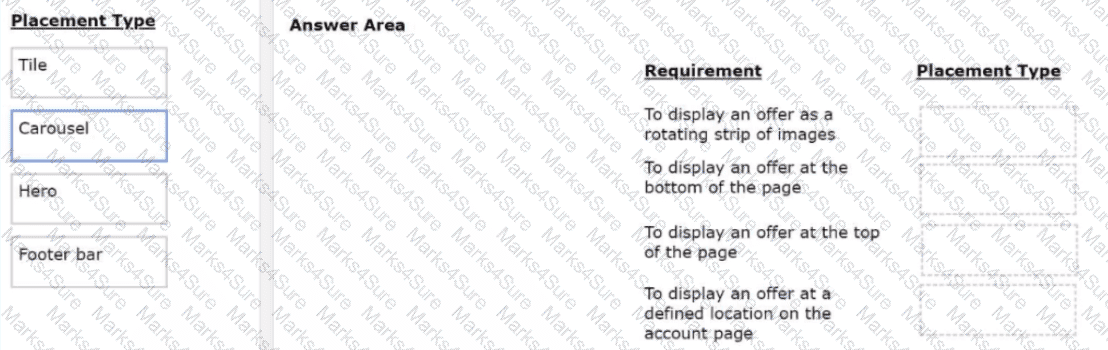

U+ Bank has decided to use the Pega Customer Decision Hub, M to recommend more relevant banner ads to its customers when they visit the personal portal. Select each placement type on the left and drag it to the correct requirement on the right.

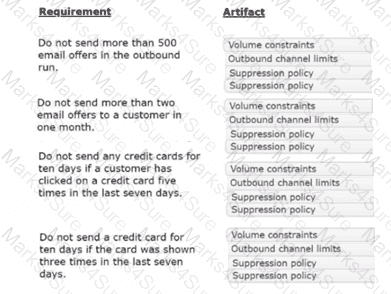

U+ Bank's marketing department currently promotes various credit card offers by sending emails to qualified customers. The bank wants to limit the number of offers that customers can receive over a given period of time.

In the Answer Area, select the correct artifact you use to implement each requirement.