Jasmine works for a Saskatchewan employer and earns $500.00 weekly. Calculate her Employment Insurance (EI) premium.

Anthony earns $750.00 per week. He has a cash taxable benefit of $25.00 per week. Anthony is exempt from CPP contributions. Calculate the net taxable income for the week.

What is the portion of a retiring allowance eligible to be transferred into a Registered Retirement Savings Plan (RRSP) or a registered pension plan (RPP) tax free based on?

Dollar amounts that are paid to an employee to cover expenses that they incurred while performing their job, but are not considered in the calculation of an employee’s earnings are:

Select the correct order of priority for withholding payroll deductions from an employee’s earnings.

Ronda earns $12.50 per hour and worked 40 hours this week. Calculate her Canada Pension Plan (CPP) contribution for this weekly pay period.

In Block 6 of the Record of Employment, what pay period type is entered for employees who are paid salary plus regularly paid commission?

PF1 Exam – Net Pay Calculation (Template Worksheet)

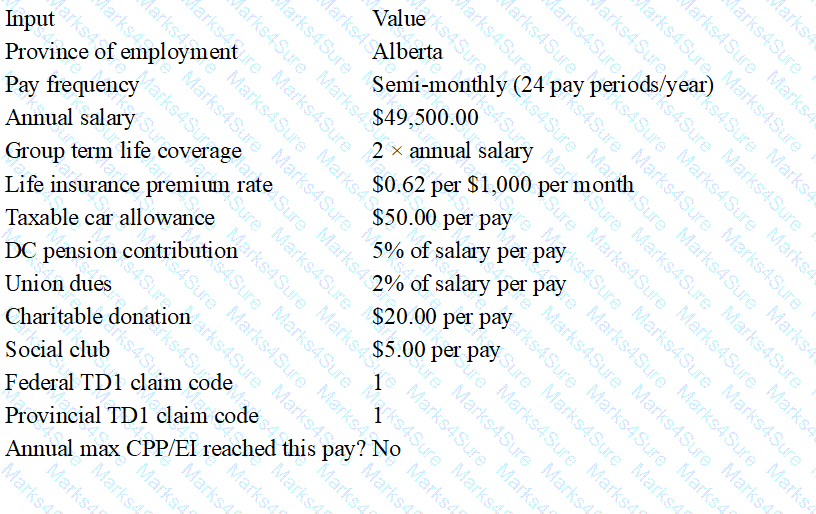

Scenario

Diane Lemay works for Monarch Construction in Alberta and earns an annual salary of $49,500.00, paid on a semi-monthly basis.

The company provides its employees with group term life insurance coverage of two times annual salary and pays a monthly premium of $0.62 per $1,000.00 of coverage.

Diane uses her car to meet with clients on company business and receives a taxable car allowance of $50.00 per pay.

The company has a defined contribution pension plan to which Diane contributes 5% of her salary each pay.

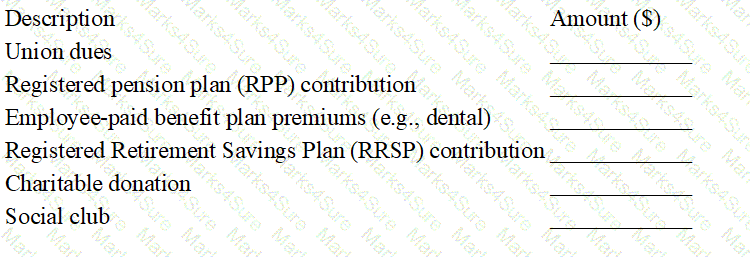

Diane also contributes $20.00 to United Way and has $5.00 deducted for her social club membership each pay. She belongs to a union and pays 2% of her salary in union dues per pay period.

Diane’s federal and provincial TD1 claim codes are 1. She will not reach the first Canada Pension Plan or Employment Insurance annual maximums this pay period.

Required: Calculate the employee’s net pay, following the order of the steps in the net pay template.

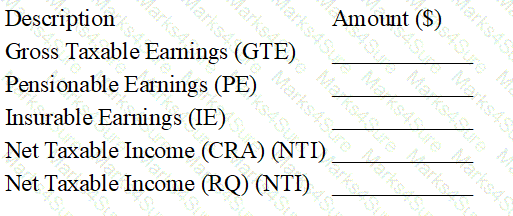

EXHIBIT A — Net Pay Template (Fill in all blanks)

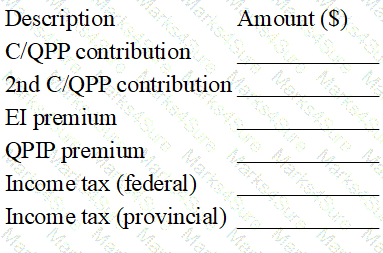

STATUTORY DEDUCTIONS

OTHER DEDUCTIONS

Given Data (Reference)

Step 1 — Calculate the employee’s gross taxable earnings (GTE) for this pay.

[ _________________________________ ]

Step 2 — Calculate the pensionable earnings (PE).

[ _________________________________ ]

Step 3 — Calculate the insurable earnings (IE).

[ _________________________________ ]

Step 4 — Calculate the net taxable income (CRA) (NTI).

[ _________________________________ ]

Step 5 — Calculate the net taxable income (RQ) (NTI).

[ _________________________________ ]

Step 6 — Calculate Diane’s Canada Pension Plan contribution.

[ _________________________________ ]

Step 7 — Calculate Diane’s Employment Insurance premium.

[ _________________________________ ]

Step 8 — Calculate Diane’s Quebec Parental Insurance Plan premium.

[ _________________________________ ]

Step 9 — Determine Diane’s federal income tax.

[ _________________________________ ]

Step 10 — Determine Diane’s provincial income tax.

[ _________________________________ ]

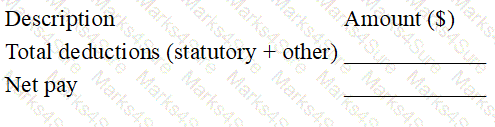

Step 11 — Calculate Diane’s total deductions (statutory + other).

[ _________________________________ ]

Step 12 — Calculate Diane’s net pay.

[ _________________________________ ]

Ursula is 17 years old, works in Quebec and earns $750.00 weekly. Ursula pays weekly union dues of $18.00 along with a special weekly union assessment of $10.00 for construction of a new union hall for its members. Ursula also has registered pension plan (RPP) contributions of $20.00 deducted from each pay. Calculate Ursula’s net federal taxable income.

Dollar values attributed to something the employer has either provided to an employee or paid for on an employee’s behalf are:

Which of the following types of payments made by a private organization would not be subject to all statutory deductions?

The deduction for living in a prescribed zone can be claimed by residents of which jurisdictions?

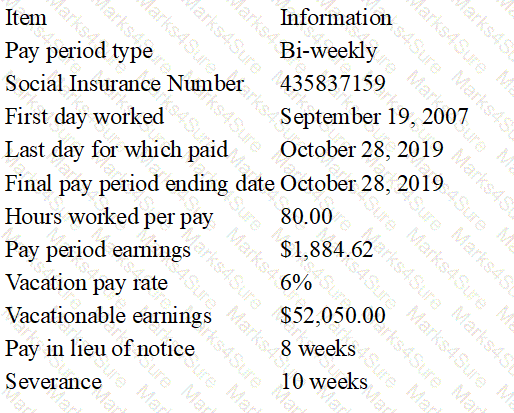

National Hardware, an Ontario organization, will be terminating the employment of Emilie St. Germain on October 28, 2019, the last day of the pay period. Emilie started with National Hardware on September 19, 2007. Complete the paper Record of Employment (ROE) for Emilie based on the information provided in the following chart.

Note: Vacationable earnings already include the pay in lieu of notice.

All dates must be entered in the format DDMMYYYY.

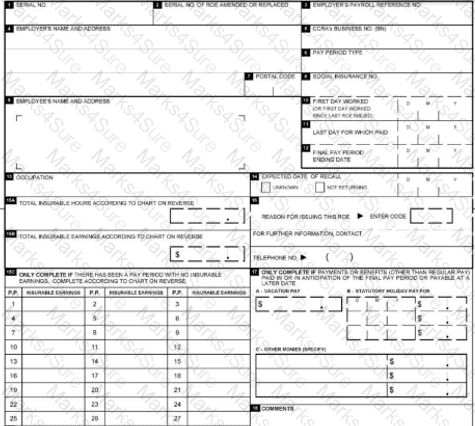

Paper ROE (Form Reference)

Complete the following paper ROE blocks for Emilie:

Block 6 – Pay period type

Block 8 – Social Insurance Number

Block 10 – First day worked

Block 11 – Last day for which paid

Block 12 – Final pay period ending date

Block 15A – Total insurable hours

Block 15B – Total insurable earnings

Block 17A – Vacation pay

Block 17C – Other monies (Pay in lieu of notice)

Block 17C – Other monies (Severance)

Step 1 — Complete Block 6

Enter the pay period type for Emilie.

Step 2 — Complete Block 8

Enter Emilie’s Social Insurance Number.

Step 3 — Complete Block 10

Enter Emilie’s first day worked in DDMMYYYY format.

Step 4 — Complete Block 11

Enter Emilie’s last day for which paid in DDMMYYYY format.

Step 5 — Complete Block 12

Enter the final pay period ending date in DDMMYYYY format.

Step 6 — Complete Block 15A

Calculate and enter total insurable hours.

Given:

Hours worked per pay period = 80.00

Bi-weekly ROE pay period chart captures 27 pay periods

Step 7 — Complete Block 15B

Calculate and enter total insurable earnings.

Given:

Pay period earnings = $1,884.62

Bi-weekly ROE pay period chart captures 27 pay periods

Step 8 — Complete Block 17A

Calculate and enter vacation pay.

Given:

Vacation pay rate = 6%

Vacationable earnings = $52,050.00

(already includes pay in lieu of notice)

Step 9 — Complete Block 17C

Enter the correct amount in 17C for “Other monies” specified as Pay in lieu of notice.

Given:

Pay in lieu of notice = 8 weeks

Use weekly earnings derived from the bi-weekly pay period earnings.

Step 10 — Complete Block 17C

Enter the correct amount in 17C for “Other monies” specified as Severance.

Given:

Severance = 10 weeks

Use the same weekly earnings used in Step 9.